-

Mental Health and Your Credit Cards: A “Sad” and “Hopeless” Situation

A Debt.com survey finds that big balances and steep interest rates are costing Americans much more than money.

-

66% of Americans Say Tariff-Driven Inflation Is Taking a Mental Toll

Debt.com survey reveals a strong link between financial pressures and emotional health during Mental Health Awareness Month

-

Death & Debt

Death & Debt You’ve heard of living expenses. Are you aware of death expenses? A funeral can cost an average of $12,000. It doesn’t need to cost so much. The…

-

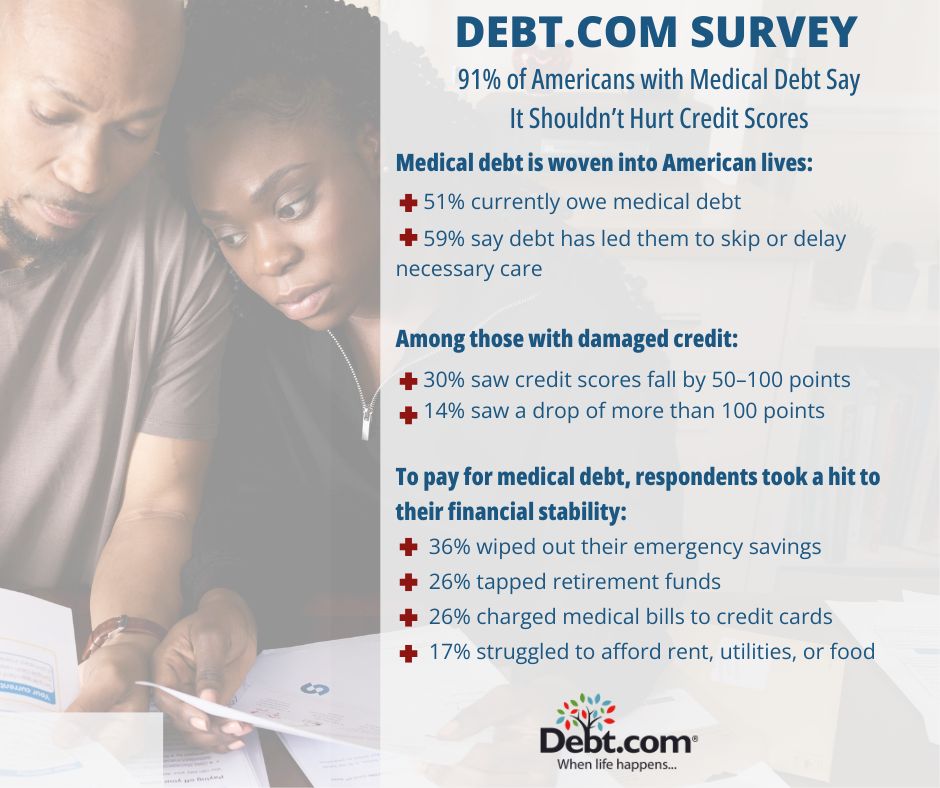

Debt.com Survey: 91% of Americans with Medical Debt Say It Shouldn’t Hurt Credit Scores – But Political Attacks on CFPB Put New Protections at Risk

FORT LAUDERDALE, FL – April 28, 2025 – A new national survey from Debt.com finds 9 in 10 Americans with medical debt believe it should not appear on credit reports,…

-

Medical Debt Survey: 9 in 10 Americans with Medical Debt Say it Shouldn’t Hurt Their Credit.

More than half say past-due medical bills have damaged their credit scores.

-

Fix Your Credit

Start Building Better Credit Today Good credit is essential. You qualify for loans and credit cards at the best rates and terms, saving money and making it easier to manage…

-

Debt.com’s 2025 Credit Card Survey Reveals Alarming Credit Card Debt Trends as Inflation Continues to Strain American Wallets

FT. LAUDERDALE, FL – March 25, 2025 – As lawmakers propose new legislation to cap sky-high credit card interest rates, Debt.com’s latest Credit Card Survey reveals just how deeply inflation…

-

Credit Card Survey: Inflation is Still Contributing to Debt

One in three Americans need credit cards to make ends meet – and many are maxed out.

-

How to Dispute Credit Report Errors

Credit reports can contain incorrect information. You can dispute mistakes and have them removed.

-

Debt.com Survey: Student Loan Borrowers Fear What Trump’s Second Term Means for Their Debt

Many Feel “Nervous” and “Overwhelmed” as SAVE Repayments Resume in April FORT LAUDERDALE, FL –Feb. 25, 2025 – As President Donald Trump starts his second term, millions of student loan…

-

Student Loan Forgiveness Survey: 3 in 5 Borrowers Are Concerned About President Trump’s Second Term

Many are “nervous” and “overwhelmed” about how to afford payments when SAVE payments resume in April.

-

Debt Awareness Week Helps Americans Confront Rising Debt: How Many Days Do People Have to Work Just to Pay Off Debt?

Debt.com’s weeklong financial education campaign aims to reduce debt stigma and empower consumers.

-

Debt Settlement Gains Awareness and Approval

Debt.com’s research shows debt settlement is becoming a popular solution in today’s economy.

-

Debt Settlement Survey: 9 in 10 Americans Have Heard of Debt Settlement – Most Say “It’s a Helpful Way to Deal With Debts”

The results of Debt.com’s latest survey of 1,000 Americans has surprised our team of in-house experts of CPAs and debt management professionals: Most are aware of the powerful solution called…

-

An AI Crime Surge? 3 in 5 Americans Feel Artificial Intelligence Will Create More Identity Theft in 2025

Debt.com survey shows 43% have already had their identities stolen – and more than 1 in 5 were children