-

Did My Wife Claim Our Children Illegally?

Just because your spouse decides to scam the IRS, it doesn’t excuse you from filing.

-

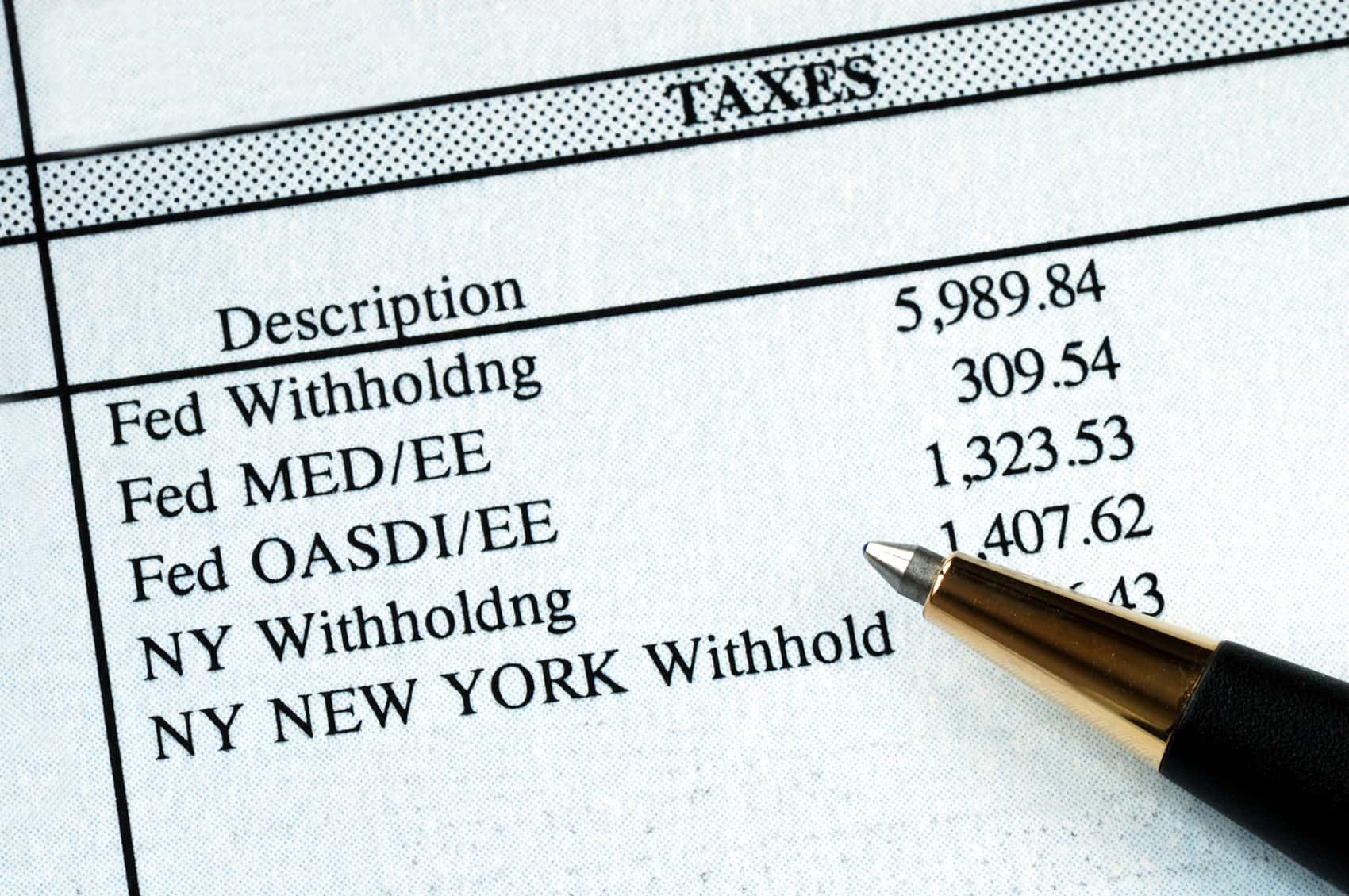

How Much Tax Should I Withhold?

A reader wants to know how to set income tax withholding on a new job to avoid a tax bill in April.

-

Are Real Estate Losses Tax Deductible?

A reader wants to know if there’s any silver lining to taking a loss on a real estate investment.

-

How to Transfer an IRA CD From one Bank to Another Without Getting Taxed

The IRS wants to charge a retiree for moving his IRA CD, but he may be able to avoid getting taxed.

-

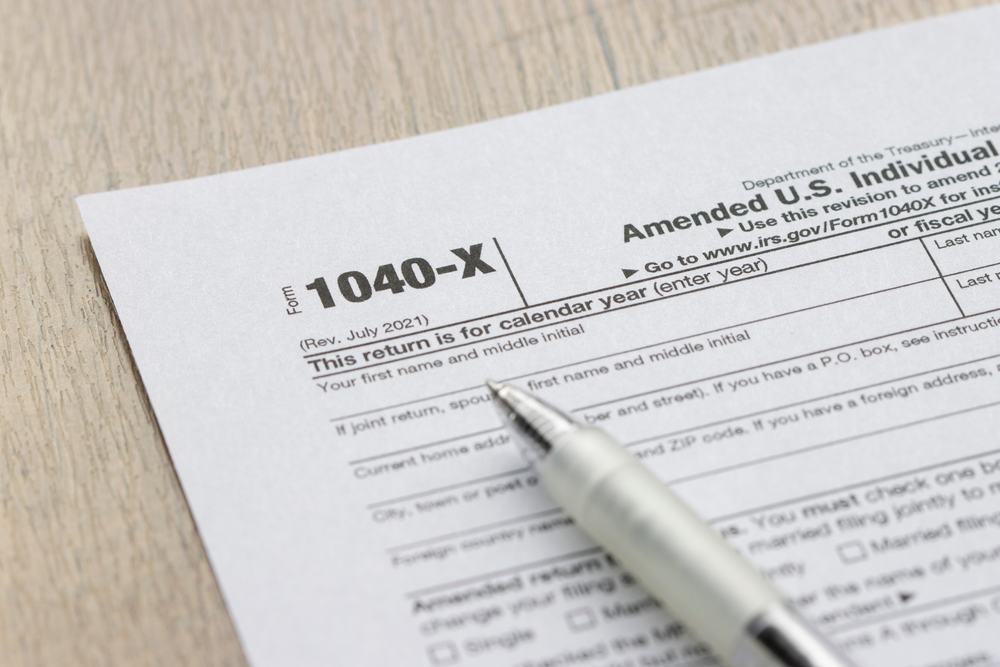

How Long Does It Take the IRS to Issue an Amended Tax Return Refund?

Filing form 1040X may get you your refund, but don’t expect a fast turnaround.

-

Can I Deduct Funeral Expenses From My Income Taxes?

The simple answer is no, but it’s never simple with the IRS.

-

Can Married Couples File Taxes Separately?

A reader’s wife has left him, but they’re still married. Yet she just filed her own taxes.

-

What Receipts Should I Keep for Taxes?

The answer has more to do with your job than your expenses.

-

What is the Late Filing Penalty for Form 1120?

A reader never did her S-Corp filing. How much pain is she facing?

-

How Does A Supreme Court Ruling Affect My Online Business?

A reader worries that her side business will face huge tax problems.

-

How Long Should I Keep Receipts For Tax Purposes?

A reader’s simple question has no simple answer.

-

Can I Pay Off My Student Loans By Betting On Sports?

A reader plans to do just that, but he wants tax advice first. He’ll get more than he bargained for.

-

How are Commissions Taxed and Is My New Contract Stiffing Me?

A reader is finding customers for a construction firm. But is he being bulldozed?