Depending on your financial situation, more debt relief options exist than bankruptcy.

Facing overwhelming debt can feel like navigating a maze with no exit in sight. The stress and uncertainty can weigh heavily on your mental and emotional well-being, but it’s important to know that there are multiple paths to take that don’t involve filing for bankruptcy. Bankruptcy may seem like the only solution, but there are several approaches you can take to alleviate debt without the long-term consequences that bankruptcy often brings. What are the alternatives to filing for bankruptcy? Let’s delve into the options to help you regain control of your finances and find the right bankruptcy alternative that works for you.

Whether you are dealing with medical bills, credit card debt, personal loans, or a mortgage, there are solutions available that can help you take back control and alleviate financial stress. Understanding and evaluating these alternatives allows you to create a debt relief plan that fits your specific needs and circumstances. With patience, careful planning, and determination, you can rebuild your financial future and find hope where there once seemed to be none.

Table of Contents

Avoiding Bankruptcy

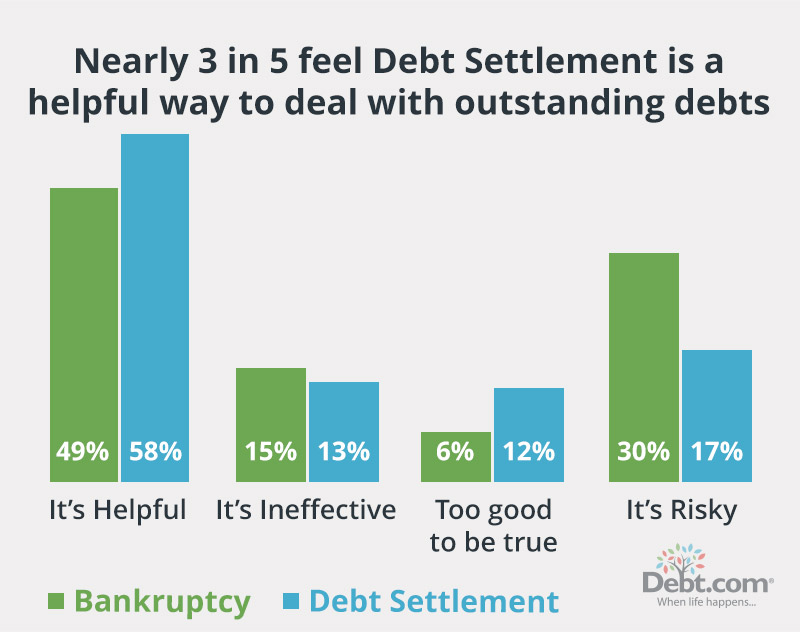

Financial strategies like a debt management or debt settlement plan can help you get your finances back on track and avoid the stigma and consequences often associated with bankruptcy filings.

Your first option would be to consult a nonprofit credit counseling agency. Nonprofits work in the debtor’s best interest. Filing for bankruptcy costs time, money, and damage to your credit. Bankruptcy involves working with an attorney through the legal process.

The two most common types of personal bankruptcy are Chapter 7 and Chapter 13. Attorney fees can range between $750 and $4,500, and filing fees are another $300 to $400.

Bankruptcy Alternatives

If your credit is good, several strategies can help you manage debt without declaring bankruptcy. The key is finding a manageable solution that meets your needs and helps you regain control of your finances without the significant downsides of bankruptcy.

Debt Consolidation

Simplify your debts into a single, more manageable payment.

- Balance Transfer: Move high-interest credit card debt to a card with a lower rate. Watch out for transfer fees and the expiration of promotional rates. Balance transfers can be effective, but only if you can pay off the balance within the promotional period.

- Debt Consolidation Loan: Obtain a loan to pay off multiple debts, ideally with a lower interest rate. This is one of the most common alternatives to filing for bankruptcy and can streamline monthly payments.

Debt Negotiation

Work with creditors to modify your debt terms, making it a viable alternative to bankruptcies.

- Direct Negotiation: Contact creditors to request reduced interest rates or extended payment periods. Being upfront and honest about your financial difficulties can lead to more manageable payment schedules.

- Debt Settlement Companies: These companies negotiate on your behalf. Be cautious and research their legitimacy through the Federal Trade Commission. Debt settlement can help you reduce the overall amount you owe, but ensure you work with a reputable company that understands your needs.

Credit Counseling

Seek professional assistance to manage your finances.

- Debt Management Plans: Credit counselors help you create a budget and negotiate with creditors as an alternative to bankruptcies. Debt management plans typically involve structured repayment plans and can help you stay organized and on track.

- Financial Education: Learn strategies for budgeting, credit management, and avoiding future debt through non-bankruptcy alternatives. These resources can empower you to make informed decisions to resolve your current debt and prevent future problems.

Nonprofit organizations like Money Management International offer these services. They can provide education and support to help you make informed decisions and regain financial independence.

Repayment Plans

Collaborate with creditors to make payment arrangements that fit your budget.

- Payment Plans: Set up schedules that prevent defaults and keep you on track as an option besides bankruptcy. Payment plans effectively honor your debts without declaring bankruptcy and allow you to manage repayments without accumulating additional penalties or fees.

- Debt Forgiveness Programs: Some nonprofits or government programs may forgive a portion of your debt, providing viable bankruptcy alternatives for individuals. Investigating debt forgiveness options can yield opportunities that will lessen the overall burden of your debts.

Chapter 13 Bankruptcy

If Chapter 7 isn’t an option, Chapter 13 might be.

- Repayment Plan: Pay off debts under court supervision over three to five years. Chapter 13 allows individuals to keep their property while adhering to a court-approved repayment schedule.

- Asset Protection: Allows you to keep your home and other assets while exploring other alternatives to filing for bankruptcy. While this option still involves bankruptcy, the impact on your credit may be less severe than Chapter 7.

Consult a bankruptcy attorney to explore this alternative to bankruptcy. They can help assess your financial situation and decide if Chapter 13 best fits you or whether a non-bankruptcy solution is more suitable.

Talk to a debt professional who can help you decide which bankruptcy alternative makes sense for you.

How to Get Rid of Debt Without Filing Bankruptcy

Before considering bankruptcy, it is crucial to explore how to get rid of debt without filing bankruptcy. This involves understanding and implementing various strategies to effectively manage and reduce one’s debt burden without resorting to legal declarations of insolvency.

Budgeting and Financial Planning

Creating a detailed budget is a foundational step in managing your finances. Budgeting and financial planning can highlight unnecessary expenses, serving as powerful tools in avoiding bankruptcy. Could you brew coffee at home instead of buying that daily latte? Small savings add up over time, freeing up funds to pay down debt and exploring options other than bankruptcy. Budgeting can also help you identify specific categories where you may be overspending and redirect those funds toward debt payments, thus improving your overall financial health.

Implement Anti-Harassment Laws

Did you know there are laws to protect you from aggressive debt collectors? The Fair Debt Collection Practices Act (FDCPA) prohibits harassment and unfair practices. Understanding your rights can reduce stress and give you space to manage your debt effectively, which is a critical alternative to filing bankruptcy. Knowing your rights under the law can help empower you to negotiate with creditors and make informed decisions regarding your financial situation.

Attempt to Negotiate Better Terms

Have you considered reaching out to your creditors? They might be willing to lower interest rates or extend payment terms, which is a great alternative to bankruptcy. Creditors often prefer to receive reduced payments rather than none, making this an effective way to avoid bankruptcy. Negotiation might include requesting lower interest rates, setting up a reduced payment schedule, or requesting temporary payment deferment.

Budget to Cut Out Excess Spending

Budget to cut out excess spending is another effective strategy. Creating a detailed budget can highlight unnecessary expenses, serving as a powerful tool in avoiding bankruptcy. Small changes, like brewing coffee at home instead of buying daily lattes, can lead to significant savings over time, allowing you to allocate more funds toward debt repayment.

Increase Your Income

Looking for ways to boost your income is a non-bankruptcy alternative that can help you eliminate debt without filing bankruptcy. Side gigs or freelance work can provide extra cash. Websites like Upwork or Fiverr offer platforms to monetize your skills, providing you with effective options besides bankruptcy. In addition, you could consider taking on part-time work, selling unused items, or leveraging hobbies and skills to generate additional income streams, all of which can be directed toward paying off your debt.

Use Your Savings to Pay Off Debts

While it might be tough to dip into your savings, using them to pay off debts can save you money in the long run. It is a strong alternative to filing for bankruptcy and an effective way to tackle your financial burden. However, leaving an emergency fund intact is important to prevent future financial issues. Using savings strategically and responsibly can help you reduce debt while still maintaining a safety net for unexpected expenses.

Understanding Your Finances

Gaining clarity on your financial situation is crucial for making informed decisions about which of the following is not considered a good option for bankruptcy and what alternatives to bankruptcy are best for you. Understanding where you stand financially will help you choose the right debt management option and give you insight into your spending habits and areas for improvement.

Credit Score Impact

Be mindful that some debt relief options may affect your credit score. Before making any moves, consider how each bankruptcy alternative could influence your future financial opportunities. Maintaining a good credit score can open up more favorable loan terms in the future, so consider how debt repayment options impact your creditworthiness.

Professional Guidance

Feeling overwhelmed? A financial advisor or credit counselor can provide personalized advice on alternatives to bankruptcy. Organizations like the National Foundation for Credit Counseling offer free or low-cost counseling services to help you avoid filing for bankruptcy. A professional can help you analyze your debt situation, negotiate with creditors, and develop a long-term financial plan tailored to your specific needs. Financial counseling services often come with a wealth of resources and can help you improve your financial literacy, making it easier for you to manage your finances independently.

Long-Term Financial Planning

Developing a long-term financial plan helps prevent future debt accumulation and is a valuable alternative to filing for bankruptcy. Setting financial goals and tracking your progress can keep you on the right path. By creating a plan that includes debt repayment, emergency savings, and long-term financial goals, you can set yourself up for future success while avoiding the need for drastic solutions like bankruptcy.

Stop Making Payments & Do Nothing

While ignoring debts might seem like an easy out, it’s a dangerous path with severe consequences. Doing nothing will only worsen your financial issues and limit your ability to access credit in the future.

Negative Impacts of Non-Payment

- Increased Debt: Interest and penalties will continue to accrue, increasing your overall debt burden.

- Damaged Credit Score: Late payments can significantly lower your credit score, making future borrowing difficult.

- Wage Garnishment: Creditors may obtain court orders to deduct money directly from your paycheck.

- Lawsuits: You could face legal action, leading to additional fees and judgments against you.

- Repossession: Assets like your car or home could be seized if they’re tied to your debt.

Is short-term relief worth long-term financial hardship? It is always better to choose alternatives to filing bankruptcy instead of ignoring debt. Proactively addressing debt issues, even if it means reaching out for help, is preferable to letting the problem grow unchecked.

Understanding Bankruptcy Ineligibility

Before exploring alternatives to bankruptcy, it’s crucial to understand why bankruptcy might not be an option for you. Filing for bankruptcy is a significant financial decision that can offer relief from overwhelming debt, but not everyone qualifies. Various factors can disqualify you from filing, and for some individuals, the long-term impacts of bankruptcy may outweigh the immediate relief it provides. Understanding these eligibility criteria and the potential barriers can help you make informed decisions about managing your debt and exploring other viable options.

Recent Bankruptcy Filings

If you’ve filed for bankruptcy recently, you may be barred from filing again for a certain period. If you recently filed and are struggling again, you may need to speak with a credit or debt counselor and wrangle your budget with financial education. In such cases, looking for other options besides bankruptcy is critical. Repeat filings can further damage your credit and may not be the best way to manage debt. Non-bankruptcy alternatives, such as debt consolidation, credit counseling, or debt management plans, might help you regain financial control without facing additional filing restrictions. Seeking professional guidance can provide you with personalized strategies to overcome your financial challenges and build a more secure financial future.

High Income

You may not qualify for Chapter 7 bankruptcy if your income exceeds certain thresholds. The means test determines eligibility based on your state’s median income. In this situation, you might need to look into bankruptcy alternatives for individuals. Chapter 13 bankruptcy or non-bankruptcy alternatives, such as debt settlement or consolidation, may better suit individuals with higher incomes.

Significant Assets

Owning valuable assets may require liquidation to pay off debts in bankruptcy proceedings. This could include property, investments, or luxury items, making alternatives to bankruptcy a more attractive choice. In Chapter 7 bankruptcy, assets are sold to repay creditors, while Chapter 13 may require you to pay off a significant amount of your debt over time.

Using Your Equity to Avoid Bankruptcy

Tapping into your assets can be an option, but it’s essential to understand the risks involved in these alternatives to bankruptcy. Equity in your home or life insurance policies can be used strategically, but the consequences of failure to repay should not be underestimated.

If you have investments, it may be tempting to cash them in to pay off debt, but that’s not the best plan. Selling investments prematurely can lead to significant financial losses, especially if the market is experiencing a downturn.

Additionally, liquidating investments may incur taxes and penalties, further reducing the amount available to settle your debts. Beyond the immediate financial implications, cashing in investments diminishes your long-term wealth-building potential, potentially jeopardizing your future financial security.

Instead of liquidating investments, consider other ways to leverage your equity, such as obtaining a home equity loan or a line of credit, which can offer lower interest rates and more favorable repayment terms. These options allow you to access necessary funds while preserving your investment portfolio and maintaining your financial growth trajectory.

Always consult a financial advisor to evaluate the best strategy tailored to your financial situation and goals.

Home Equity Loans or Lines of Credit

- Borrowing against your home’s equity can provide funds to pay off debts.

- Cash-Out Refinancing: You replace your existing mortgage with a new one for more than you owe and receive the difference in cash.

- Risk: Failure to repay could result in losing your home. Are you willing to take that chance or look for other bankruptcy alternatives? Utilizing home equity can be beneficial for consolidating higher-interest debt, but it’s crucial to recognize the significant risk involved if you cannot meet payments.

Retirement Savings

Accessing retirement funds might seem tempting, but consider the consequences.

- Penalization: Early withdrawals from 401(k)s or IRAs incur taxes and penalties.

- Future Financial Security: Depleting retirement savings jeopardizes your long-term financial stability.

- Lost Investment Growth: Withdrawing now means missing out on potential growth from compound interest.

Is solving today’s problem worth sacrificing your future comfort, or are there alternatives to filing for bankruptcy that could work better? Consider other means of debt management before tapping into retirement funds, as early withdrawal penalties and loss of potential growth can significantly impact your future.

Insurance Policies

Some life insurance policies have a cash value you can access.

- Cash Surrender Value: Withdrawing reduces the death benefit for your beneficiaries.

- Policy Termination: Cashing out may end your coverage when you need it most.

- High Costs: Fees and charges can diminish the amount you receive.

Consult with an insurance professional before making this decision and seriously consider other alternatives to bankruptcy. Reducing or eliminating your life insurance policy is highly discouraged, as it can have severe long-term consequences for your family’s financial security. Life insurance provides essential protection to safeguard your loved ones against unexpected financial hardships in your absence.

By cutting back on or canceling your policy, you jeopardize your family’s future stability and risk losing valuable benefits that could help cover debts, living expenses, and other critical needs. Additionally, reinstating a life insurance policy after cancellation can be difficult and may come with higher premiums or denial based on your current financial situation. Therefore, it is crucial to weigh these impacts carefully and explore more viable debt management strategies that do not compromise the financial well-being of your family. Prioritizing your life insurance ensures that your family remains protected and secure regardless of your financial challenges.

Alternatives for Specific Debt

Different types of debt may require tailored solutions. Here are some options besides bankruptcies for managing specific debts effectively and regaining financial stability.

Mortgage Debt

Refinancing

Refinancing your mortgage involves replacing your existing home loan with a new one, typically with different terms and interest rates. This strategy can be an effective alternative to bankruptcy for managing mortgage debt and improving your financial situation. Securing a lower interest rate can reduce your monthly payments, making your mortgage more affordable and freeing up additional funds to address other debts. Additionally, refinancing may allow you to extend the loan term, further decreasing your monthly obligations and providing greater financial flexibility.

Another advantage of refinancing is the potential to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, which can offer more predictable payments and protect you from future interest rate increases. However, it’s essential to consider the costs associated with refinancing, such as closing fees, appraisal fees, and potential penalties for early repayment of your current loan. These expenses can add up and may offset some of the financial benefits if not carefully evaluated.

Before deciding to refinance, assess your current financial health, credit score, and overall market conditions. Consulting with a financial advisor or mortgage specialist can provide personalized insights and help determine whether refinancing aligns with your long-term financial goals. By thoughtfully leveraging refinancing, you can effectively manage your mortgage debt, enhance your financial stability, and avoid the drastic step of filing for bankruptcy.

- Lower Interest Rates: Secure a lower rate to reduce monthly payments. Refinancing can help make mortgage payments more manageable and free up funds to pay down other debts.

- Longer Terms: Extend the loan term to decrease payments, though the total interest paid may increase. These alternatives to bankruptcy can help you manage mortgage debt effectively without risking foreclosure.

Mortgage Modification

- Loan Modification Programs: Adjust loan terms through programs like the Home Affordable Modification Program (HAMP). Loan modification can lower payments and help you remain in your home, making it a better alternative to bankruptcy for those struggling with mortgage debt.

Selling Your Home

Selling your home is a significant financial decision that can be a viable alternative to bankruptcy for managing mortgage debt. This strategy involves transferring ownership of your property to a buyer, with the proceeds used to pay off your existing mortgage and potentially other outstanding debts. There are primarily two approaches to selling your home: a profitable sale and a short sale.

- Profitable Sale: Use proceeds to pay off the mortgage and other debts. Selling your home might be the best way to regain financial stability, especially if you have equity that can be used to settle outstanding obligations.

- Short Sale: With lender approval, you can sell the home for less than you owe, though it may impact your credit score. Short sales can help you avoid foreclosure and offer an alternative to more damaging financial consequences.

Rental Income

Rental Income involves generating additional funds by renting out a portion of your property to tenants, such as a spare room, basement, or an entire unit. This strategy can serve as a practical alternative to bankruptcy by providing a steady stream of income that can be directed toward paying down your mortgage and other debts. By leveraging the unused space in your home, you can enhance your financial stability without making significant changes to your living arrangements.

One of the primary advantages of generating rental income is the potential to cover a substantial portion of your mortgage payments, thereby reducing your financial burden. Additionally, rental income can help you build equity in your property more quickly and provide a buffer during periods of financial hardship. However, it’s essential to approach this option carefully and consider the responsibilities involved in being a landlord.

- Renting Out Space: Generate income by renting a room or property, applying earnings toward your mortgage as an option besides bankruptcy. This approach allows you to leverage your property to meet financial obligations without taking drastic measures.

Student Loan Debt

Government-Based Repayment Plans

Government-Based Repayment Plans are structured programs the federal government offers to help individuals manage their student loan debt more effectively. These plans adjust your monthly loan payments based on your income, family size, and financial circumstances, ensuring that repayment remains affordable even during periods of financial hardship. By providing flexible payment options and pathways to loan forgiveness, these government-backed programs offer a viable alternative to bankruptcy for those struggling with student loan debt.

Government-based repayment Plans encompass a variety of programs tailored to accommodate different financial situations. The primary goal of these plans is to align student loan payments with your ability to pay, thereby reducing the risk of default and making debt management more sustainable. These plans include Income-Driven Repayment Plans (IDRPs), Public Service Loan Forgiveness (PSLF), and other specialized repayment options that provide borrowers with flexibility and support in navigating their financial obligations.

- Income-Driven Repayment Plans (IDRPs): These plans adjust payments based on income and family size. They are an accessible alternative to filing for bankruptcy for many people struggling with federal student loan payments.

- Public Service Loan Forgiveness (PSLF): This option forgives remaining debt after 10 years of qualifying public service work. It provides significant relief for those in the public sector, making it a good alternative to bankruptcy.

- Income-Contingent Repayment (ICR): Calculates payments based on income, family size, and loan amount.

- Revised Pay As You Earn (REPAYE): Caps payments at 10% of discretionary income. These are good alternatives to filing for bankruptcy when dealing with student loans and help ensure reasonable payments.

Explore options on the Federal Student Aid website.

Other Repayment Strategies

- Deferment and Forbearance: These methods temporarily pause payments during hardship. While temporary, they provide breathing room to get finances in order.

- Loan Consolidation: This option combines multiple loans into one for simplicity. It can lower your interest rates and help you organize your repayments.

- Loan Refinancing: Obtain a new loan with better terms to pay off existing loans. These are all valid non-bankruptcy alternatives and can reduce monthly payments or overall interest.

Medical Debt

Negotiation and Payment Plans

Negotiation and Payment Plans are proactive strategies that allow individuals to work directly with their creditors to modify the terms of their debt, making repayments more manageable without resorting to bankruptcy. This approach involves initiating open and honest communication with creditors to discuss your financial difficulties and propose feasible repayment arrangements.

Negotiating lower interest rates, extended payment terms, or even partial debt forgiveness can reduce your monthly obligations and alleviate financial stress. Establishing a structured payment plan helps systematically pay down debt and demonstrates your commitment to fulfilling your financial responsibilities, which can improve your credit standing over time.

Additionally, successful negotiations can prevent negative consequences such as late fees, increased interest rates, and potential legal actions from creditors. Utilizing payment plans effectively requires careful budgeting and discipline to ensure that agreed-upon payments are made consistently.

Seeking assistance from a credit counselor or financial advisor can enhance your negotiation efforts by providing professional guidance and helping you develop a sustainable repayment strategy. Overall, negotiation and payment plans offer a viable alternative to bankruptcy by enabling debtors to regain control of their finances, maintain their credit integrity, and work toward long-term financial stability.

- Direct Negotiation: Hospitals may reduce bills if debtors can demonstrate financial hardship. Medical providers often offer discounts or payment plans for individuals who show financial need.

- Payment Plans: Spread out payments over time to make them more manageable.

- Be Persistent: Don’t be discouraged by initial refusals; persistence can pay off. Negotiating medical debt often requires multiple attempts, but persistence can result in reduced bills or more favorable payment terms.

Insurance Claims Review

Insurance Claims Review is a crucial step in managing medical debt, as it ensures that your insurance benefits are fully utilized and that any errors in claim processing are promptly addressed. Start by meticulously verifying that your insurance has correctly processed all submitted claims by comparing your Explanation of Benefits (EOB) statements with your actual medical bills.

This helps identify discrepancies such as incorrect billing codes, denied services that should have been covered, or duplicate charges that can lead to unexpected out-of-pocket expenses. If you discover that a claim was denied unjustly, you must take immediate action by appealing the decision.

Many initial denials can be overturned upon appeal by providing the necessary documentation and a clear explanation of your situation. Additionally, consulting with a patient advocate or a professional experienced in insurance claims can significantly improve your chances of a successful appeal. By diligently reviewing and managing your insurance claims, you can minimize your medical debt burden, ensure you receive the benefits you’re entitled to, and avoid the need to consider more drastic measures such as bankruptcy.

- Verify Coverage: Ensure your insurance claims are processed correctly. Errors in insurance claims can be costly, so it’s important to verify all claims.

- Appeal Denials: You can appeal if a claim was denied unjustly. Many insurance denials are overturned upon appeal, which can significantly reduce out-of-pocket expenses.

Government Programs

Government Programs play a pivotal role in alleviating medical debt by providing essential support and resources to individuals facing financial hardships related to healthcare expenses.

Medicaid is a state and federally-funded program that offers comprehensive healthcare coverage to eligible low-income individuals and families. It covers a wide range of medical services that might otherwise be unaffordable. This program helps reduce out-of-pocket costs for hospital visits, prescriptions, and long-term care, thereby preventing the accumulation of overwhelming medical debt.

The Affordable Care Act (ACA) further complements these efforts by providing subsidies and tax credits to make health insurance more accessible and affordable through the ACA marketplace. These subsidies lower monthly premiums and out-of-pocket costs, enabling individuals to receive necessary medical care without incurring excessive debt.

Additionally, many pharmaceutical companies offer Patient Assistance Programs (PAPs) to help cover the cost of medications for those who cannot afford them. These programs provide free or discounted medications, ensuring that essential treatments remain accessible and reducing the financial burden on patients. By leveraging these government-backed initiatives, individuals can manage their medical expenses more effectively, avoid accumulating debt, and maintain their financial stability despite unexpected health challenges. Exploring and utilizing these programs to navigate medical costs without resorting to more drastic measures like bankruptcy is crucial.

- Medicaid provides healthcare coverage for eligible low-income individuals. It can cover many medical costs that would otherwise be overwhelming.

- The Affordable Care Act (ACA) offers subsidies and tax credits for healthcare coverage. The ACA marketplace may offer options to help reduce medical costs.

- Patient Assistance Programs (PAPs): Pharmaceutical companies may help cover medication costs. Many drug manufacturers offer assistance programs for those who cannot afford their medications, providing an alternative to taking on more debt.

Tax Debt

Payment Plans

Payment Plans are structured agreements between you and your creditors that outline a specific schedule for repaying your debts over time. These plans are designed to prevent defaults and keep you on track, offering a manageable way to honor your financial obligations without resorting to bankruptcy.

By setting up regular, fixed payments, you can systematically reduce your debt while avoiding the accumulation of additional penalties or fees that often accompany missed or late payments. Payment plans can be tailored to fit your budget, allowing you to allocate funds efficiently and prioritize debts based on interest rates or outstanding balances.

Additionally, many creditors are willing to negotiate favorable terms for both parties, such as lowering interest rates or extending the repayment period to make payments more affordable. Implementing a payment plan helps you regain control of your finances and demonstrates your commitment to resolving your debts, which can improve your relationship with creditors and potentially enhance your credit score over time.

To establish an effective payment plan, assessing your financial situation, creating a realistic budget, and communicating openly with your creditors about your ability to pay is essential. Seeking assistance from a credit counselor or financial advisor can also provide valuable guidance in negotiating the best possible terms and ensuring that your payment plan aligns with your long-term financial goals. By diligently adhering to your payment schedule and making consistent payments, you can steadily eliminate your debt, reduce financial stress, and build a foundation for a more secure financial future without the need for drastic measures like bankruptcy.

- Installment Agreements: Set up a payment plan with the IRS to pay over time. This is a manageable alternative to bankruptcy that helps spread out the burden of tax debt.

- Offer in Compromise: If you meet the criteria, you can settle your tax debt for less than the full amount owed. This option is ideal for those who cannot realistically pay their tax debt in full.

- Audit Reconsideration: Request a review if you believe there’s an error in your tax assessment. Correcting mistakes on tax assessments can significantly reduce your tax burden.

Tax Relief Programs

Tax Relief Programs are essential resources the government provides to help individuals and businesses manage and alleviate their tax burdens, thereby serving as viable alternatives to bankruptcy for those struggling with tax debt. One of the most prominent programs is the IRS Fresh Start Initiative, which offers various options such as installment agreements, where taxpayers can pay their owed taxes over time, and Offer in Compromise (OIC), which allows eligible individuals to settle their tax debt for less than the full amount owed based on their financial situation.

Additionally, the Currently Not Collectible (CNC) status temporarily halts IRS collection activities for taxpayers experiencing significant financial hardship, providing immediate relief while they stabilize their finances. Tax Relief Programs also include Penalty Abatement, which can reduce or eliminate penalties for failing to file or pay taxes on time, and Innocent Spouse Relief, protecting individuals from joint tax liabilities due to a spouse’s or former spouse’s errors. To take advantage of these programs, taxpayers should thoroughly assess their financial circumstances and consult with a tax professional or a certified tax relief service to determine the most appropriate solution.

Navigating these programs can be complex, but with the right guidance, individuals can negotiate manageable payment plans, reduce their overall tax debt, and avoid the severe financial repercussions associated with bankruptcy. By proactively engaging with Tax Relief Programs, taxpayers can achieve greater financial stability and peace of mind, ensuring that their tax obligations do not derail their long-term financial goals.

The Fresh Start Program helps taxpayers pay back taxes and avoid liens. For more details, see the IRS Fresh Start Initiative. The Program provides options for struggling taxpayers, helping them avoid further financial difficulty.

Conclusion

Overcoming debt is challenging, but bankruptcy isn’t your only option. By exploring these alternatives to filing for bankruptcy, you can find a solution that fits your circumstances and sets you on a path toward financial stability. Understanding your options can make a significant difference in finding a solution that works for you without resorting to drastic measures.

Ready to take control of your financial future? Evaluate your options, seek professional guidance, and make informed decisions to overcome your debt challenges.

For personalized assistance, consider reaching out to Debt.com for a free consultation.

References

- Fair Debt Collection Practices Act (FDCPA): FTC Consumer Information

- National Foundation for Credit Counseling (NFCC): NFCC

- Federal Student Aid: Income-Driven Repayment Plans

- Internal Revenue Service (IRS): Payment Plans

- IRS Fresh Start Initiative: IRS Fresh Start Program

Note: This article is informational and does not constitute financial advice. Consult with a financial professional before making decisions.

By following these guidelines and exploring alternatives to bankruptcy, you’re taking proactive steps toward a brighter financial future. Remember, the best option depends on your unique situation. Stay hopeful and informed – solutions are within reach.

This article complies with ADA accessibility standards and follows APA style guidelines to ensure clarity and inclusivity for all readers.