Table of Contents

Understanding credit card payment timelines

Credit card debt can feel like a never-ending cycle, but understanding how payment timelines work is the key to getting ahead. Whether you’re trying to avoid interest charges, improve your credit score, or simply get out of debt faster, knowing when and how to pay your credit card balance makes a huge difference.

Why it’s important to know your payoff time frame

Your credit card payment timeline affects more than just your monthly budget—it impacts your financial future. Here’s why it’s crucial to understand your payoff time frame:

- Avoiding costly interest charges: If you don’t pay your full balance by the due date, interest starts accumulating quickly, making it harder to pay down debt.

- Protecting your credit score: Late or missed payments can damage your credit score, affecting your ability to get loans, mortgages, or even a good job.

- Maximizing credit card benefits: Many credit cards offer rewards or cash back, but carrying a balance with high interest can cancel out those perks.

- Planning for major purchases: If you’re looking to buy a house or a car, lenders will evaluate your credit card usage. Managing your balance properly keeps your credit utilization in check.

- Reducing financial stress: Knowing your timeline helps you create a solid debt repayment strategy, giving you peace of mind and financial control.

Common myths about credit card payments

There are plenty of misconceptions about credit card payments that can lead people into debt traps. Let’s bust some of the most common myths:

- Myth #1: Carrying a balance improves your credit score: Not true, carrying a balance does not improve your credit. Paying your balance in full each month is actually the best way to maintain a strong credit score while avoiding interest.

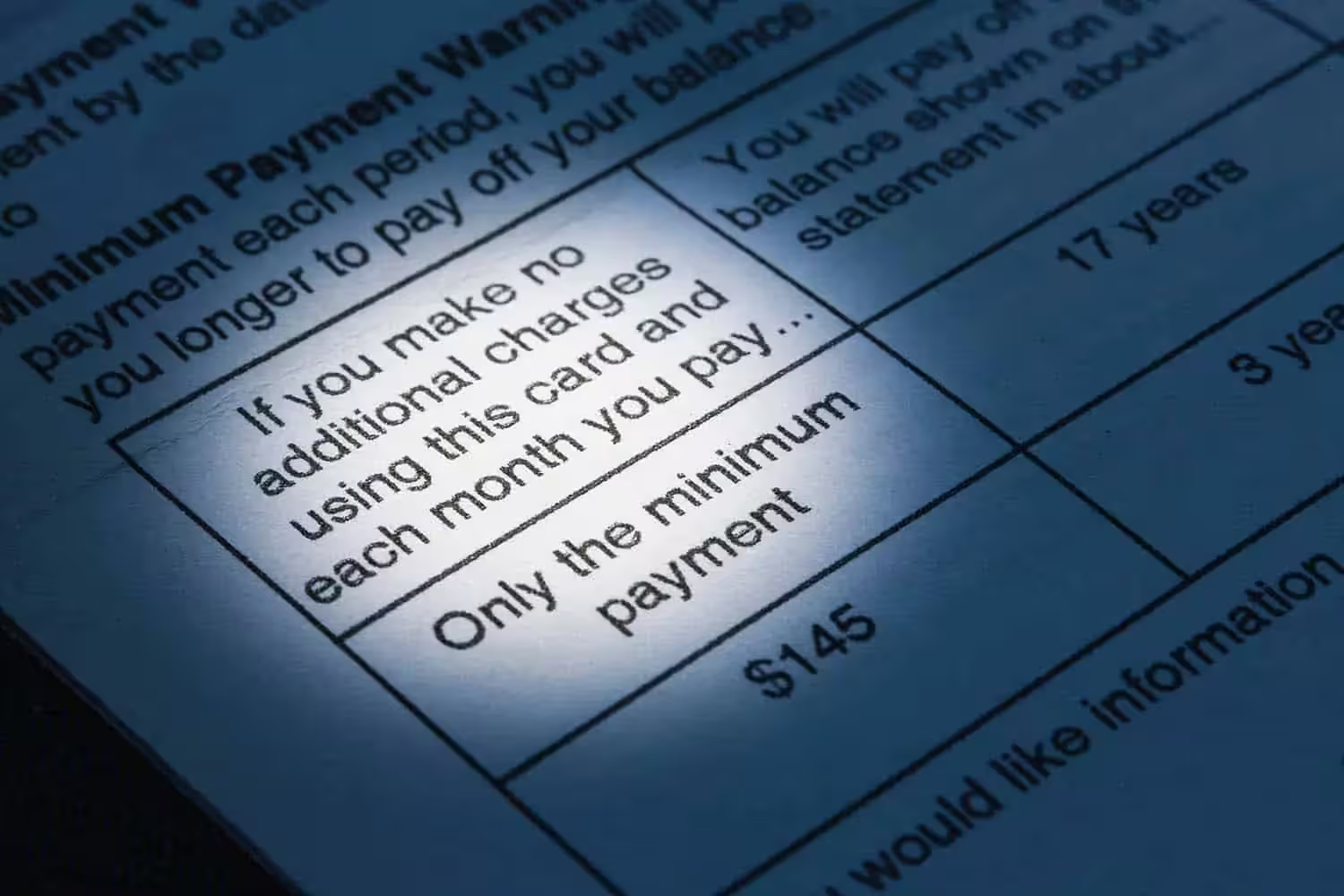

- Myth #2: Paying just the minimum is enough: While paying the minimum avoids late fees, it keeps you in debt longer and racks up significant interest.

- Myth #3: Credit card companies want you to pay off your balance in full: Actually, they prefer you to carry a balance because that’s how they make money through interest charges.

- Myth #4: There’s no penalty for paying after the due date: Late payments can trigger high fees and damage your credit score, making it harder to get favorable loan terms in the future.

- Myth #5: If you make a big payment one month, you can skip the next: Even if you overpay one month, your card issuer still expects a minimum payment the next month to keep your account in good standing.

Credit card billing cycles

Your billing cycle determines when purchases appear on your statement and when your payments are due. Knowing how it works can help you optimize your payments, avoid unnecessary interest, and stay on top of your finances.

What is a billing cycle?

A billing cycle is the period between two statement closing dates, usually lasting about 28 to 31 days. During this time, any purchases, cash advances, or balance transfers you make are tracked and added to your statement balance.

How does a credit card billing cycle work?

- Start date: Your billing cycle begins on a specific day of the month.

- Transactions: During the billing cycle, any purchases, payments, and other transactions you make with your credit card are recorded.

- End date: The billing cycle ends on a specific day of the month, which is also the closing date for that cycle.

- Statement: After the closing date, your credit card company generates a statement that summarizes all the transactions that occurred during that billing cycle. This statement will also include your previous balance (if any), any interest charges, and the minimum payment due.

- Due date: You have a specific due date to pay at least the minimum amount due on your credit card balance. This date is usually a few weeks after the statement closing date.

- New cycle: Once the billing cycle ends, a new one begins immediately, and the process repeats.

Statement dates vs. due dates

Your statement closing date and due date are two different dates on your billing cycle. Your statement closing date is the last day of your billing cycle when your monthly statement is generated. This is the balance that determines your minimum payment and interest charges if you don’t pay in full. Your due date is the final day you can make a payment before incurring late fees or interest. This is typically 21 days after the statement closing date (your grace period).

Example: If your statement closes on March 5, your due date might be March 26. Any purchases made on March 6 will appear on the next billing statement.

Grace periods and how they affect your payoff time

A grace period is the time between your statement closing date and your due date where you can pay your balance in full without incurring interest. This period is usually 21 days, but it may vary depending on your credit card issuer.

Why It Matters:

- If you pay your balance in full within the grace period, you avoid interest charges altogether.

- If you carry a balance from a previous month, your grace period disappears—meaning interest starts accruing immediately on new purchases.

- Some credit cards don’t offer grace periods, especially for cash advances and balance transfers.

Pro Tip: Set up a reminder to pay your full statement balance before your due date to maximize your grace period and avoid interest.

Minimum payments vs. full balance payments

Your monthly credit card bill gives you two payment options: paying the minimum amount due or paying more (including the full balance). While making the minimum payment keeps your account in good standing, it can also lead to skyrocketing interest charges and prolonged debt.

What happens if you only pay the minimum?

Consistently paying only the minimum amount due on your credit card has several negative consequences. Interest will accrue on the remaining balance each month, causing your total debt to increase. This, in turn, significantly lengthens the time it takes to pay off your balance, potentially adding years to your repayment schedule depending on your APR. Additionally, your credit utilization ratio (the amount of credit you’re using compared to your total available credit) will remain high, which can negatively impact your credit score. Ultimately, by only paying the minimum, you’ll end up paying substantially more in interest than the original amount you borrowed.

How interest accumulates on unpaid balances

Credit card interest is typically compounded daily, meaning interest is charged on interest from previous days. This can quickly snowball into a much larger balance if you’re only making minimum payments.

How it works:

- Your balance carries over to the next billing cycle.

- Interest is calculated daily using your APR divided by 365 (daily periodic rate).

- That daily interest is added to your balance, increasing the amount you owe.

How long does it take to pay off a $1,000 balance with minimum payments?

The answer will shock you because it will take over half a decade to pay off your debt!

Let’s say you have a credit card with a fairly 2.5% minimum payment schedule. The APR on the credit card is 18%. You run up a $1,000 and you want to pay it off. So, you stop charging and make your minimum payments on time every month to get out of debt.

The problem is that if you only stick with the minimum payment schedule, it will take 62 months to eliminate the balance in full. That’s just over five years to repay a $1,000 balance. And that’s only if you stop making charges!

The reason it takes so long is that high-interest charges eat up over half of every minimum payment you make. So, you end up only paying off a few dollars of the principal (the balance you owe) with each minimum payment.

| Month | Minimum payment | Principal Paid | Interest Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $25 | $10 | $15 | $990 |

| 2 | $25 | $10.15 | $14.85 | $979.85 |

| 3 | $25 | $10.30 | $14.70 | $969.55 |

| 4 | $25 | $10.46 | $14.54 | $959.09 |

| 5 | $25 | $10.61 | $14.39 | $948.48 |

| 6 | $25 | $10.77 | $14.23 | $937.70 |

As you can see, you spend half a year making payments and you pay $150, but you only eliminate $62.50 of the balance you owe. The more you owe, the longer you’ll be in debt. If you have a $5,000 balance on a card with the same APR and payment schedule, then you’ll be debt-free in just shy of 20 years!

Benefits of paying more than the minimum

Paying more than the minimum amount due on your credit card, or ideally paying the balance in full each month, offers several significant advantages. By paying more, you’ll accrue less interest over time, saving you money in the long run. Larger payments also accelerate your debt payoff, allowing you to become debt-free faster. Reducing your credit card balances also lowers your credit utilization ratio, which can positively impact and improve your credit score. Perhaps most importantly, eliminating debt reduces financial stress and frees up more of your income for other financial goals like saving and investing.

Pro Tip: Even if you can’t pay the full balance, paying more than the minimum can save you hundreds or thousands in interest charges.

How credit card interest works

Credit card interest is what makes carrying a balance expensive. If you don’t pay off your full balance each month, interest charges begin accumulating, often adding hundreds or even thousands of dollars to your repayment amount over time. Understanding how credit card interest works can help you make informed financial decisions and avoid unnecessary debt.

Understanding APR (Annual Percentage Rate)

A credit card’s APR (Annual Percentage Rate) determines how much interest you’ll pay on unpaid balances. The APR is expressed as a yearly rate but is applied daily to any balance that isn’t paid in full by the due date.

Types of APR include:

- Purchase APR: The interest rate applied to regular purchases.

- Cash advance APR: A much higher rate for cash withdrawals, often 25-30% or more.

- Balance transfer APR: The rate charged on balances moved from another card (often 0% for a limited period).

- Penalty APR: A significantly higher interest rate (sometimes 30% or more) applied if you miss payments.

Many credit cards have variable APRs, which change based on the Prime Rate set by the Federal Reserve. If interest rates increase, your credit card APR will likely rise as well.

How interest is calculated on your balance

Credit card interest isn’t a flat fee, it’s based on your daily balance. This means interest charges compound over time.

The formula for daily interest:

- Take your APR and divide it by 365 (days in a year) to get your daily periodic rate.

- Multiply this daily rate by your current balance.

- Interest is added to your balance each day, increasing the amount you owe.

Example: A credit card with a 20% APR translates to a daily periodic rate of approximately 0.054% (calculated by dividing 20% by 365). On a $5,000 balance, this equates to roughly $2.70 in daily interest charges. If only minimum payments are made, this interest will continue to accrue, leading to a steady increase in the overall amount owed.

Daily compounding and its impact on payoff time

Most credit cards use daily compounding, which means interest is charged every day, including on the interest that was added the day before. This accelerates the growth of your balance if you carry debt from month to month.

Why it matters:

- Even if you stop using your card, your debt continues growing due to compounding interest.

- Paying only the minimum keeps you in debt longer and significantly increases the total repayment cost.

- A high APR combined with compounding makes it much harder to pay off balances quickly.

The best way to avoid interest charges is to pay your full balance by the due date. If that’s not possible, making multiple payments each month can help reduce the amount of interest that accrues.

The role of credit utilization in payoff strategies

Your credit utilization ratio is a key factor in your credit score and plays a major role in how quickly you can pay off debt. Keeping your utilization low can help improve your credit score, lower interest costs, and accelerate debt repayment.

What is credit utilization?

Credit utilization refers to the percentage of your total credit limit that you’re using. It is calculated by dividing your current balance by your total available credit.

Formula:

(Total balance ÷ Total credit limit) × 100 = Utilization %

Example: A $5,000 credit limit with a $2,500 balance results in a 50% utilization ratio.

Why keeping utilization low matters

Low credit utilization has a positive implant on your credit score. Your utilization accounts for 30% of your FICO score, and ideally should be kept below 30%, with under 10% being even better. High utilization can negatively impact your credit score and make you appear as a higher risk to lenders. This can lead to loan denials or less favorable terms like higher interest rates. Also a lower balance generally means less interest accrues over time, saving you money and provides financial flexibility, allowing you to handle unexpected expenses without maxing out your available credit.

Strategies for reducing credit utilization over time

- Make multiple payments per month: Paying down your balance throughout the month prevents high utilization from being reported to credit bureaus.

- Request a credit limit increase: A higher limit lowers your utilization as long as you don’t increase spending.

- Pay off large balances first: Reducing high-utilization balances first improves your overall credit profile.

- Spread balances across multiple cards: Distributing balances across several accounts can help keep utilization lower on each card.

- Keep old accounts open: Closing old credit accounts reduces your total available credit, which increases your utilization ratio.

Factors that affect how long it takes to pay off a credit card

The time it takes to pay off a credit card depends on several factors, including how much you owe, your interest rate, and how much you pay each month. Understanding these variables can help you develop a strategy to eliminate your debt more efficiently.

Pro tip: A credit card payoff calculator can help estimate how long it will take to pay off your debt, along with the total interest paid.

Your total debt amount

The more you owe, the longer it will take to pay off your balance—especially if you only make minimum payments. For example a $1,000 balance can be paid off relatively quickly if you commit to larger payments, while a $10,000 balance will take significantly longer and cost more in interest unless aggressive payments are made.

Your interest rate and APR type

Your Annual Percentage Rate (APR) determines how much interest you pay on any unpaid balance. The higher the APR, the more your debt will grow over time and the longer it may take to pay off. For example a low APR (under 10%) means more of your payments go toward the principal rather than interest, while a high APR (20% or more) results in a significant portion of your payments covering interest instead of reducing your balance.

The type of APR associated with your credit card also plays a significant role in your interest costs. A fixed APR remains constant unless your card issuer specifically notifies you of a change. A variable APR fluctuates in accordance with the Prime Rate, meaning your interest costs can increase unexpectedly.

Your monthly payment amount

The size of your monthly payment is the single most important factor in determining how long it takes to pay off your credit card. Paying only the minimum results in years of debt and excessive interest costs. Increasing your monthly payment reduces interest accumulation and shortens your payoff period.

Example: A $5,000 balance at 18% APR with a minimum payment of $100 will take almost 30 years to pay off, costing over $10,000 in interest. If you increase the payment to $250 per month, you’ll pay it off in about two years, with only $900 in interest.

Paying off a credit card before the due date

Making early payments on your credit card can be a strategic way to lower interest costs and improve your financial health. But does it actually help your credit score? And should you make multiple payments a month? Let’s break it down.

Does paying early help your credit score?

Yes, paying your credit card bill early can benefit your credit score in several ways:

- Reduces credit utilization: Since utilization is calculated based on your statement balance, paying early keeps it lower, which can improve your score.

- Prevents late payments: Making early payments ensures you never miss a due date, protecting your payment history.

- Demonstrates responsible credit management: Lenders see early payments as a sign of financial discipline, which can help in loan approvals.

However, early payments won’t increase your score simply for paying ahead of schedule—your payment history and credit utilization are the key factors.

How early payments reduce interest costs

Carrying a credit card balance means you’ll accrue interest, but paying early can help minimize those costs. Credit card interest is calculated daily based on your outstanding balance. Therefore, the sooner you reduce that balance, the fewer days interest accrues. By paying early, you effectively shrink the daily interest charges, ultimately saving you money over time.

Example: If you have a $3,000 balance at 20% APR, you’re charged around $1.64 per day in interest. Paying $1,500 two weeks before the due date reduces your balance earlier, cutting the total interest you owe.

Can you make multiple payments in one month?

Yes, you can make more than one credit card payment each month, and it’s a smart idea. Making multiple payments helps keep your balance low, which is good for your credit score. It also means you’ll pay less interest. Plus, it can make it easier to manage your money, so you’re not struggling to pay everything at once. If you want to get out of debt or improve your credit, making multiple payments is a great way to do it.

Paying off a credit card after the due date

Missing a credit card payment can have immediate financial consequences, but not all late payments are equal. The sooner you act, the less damage you will face.

Late fee and penalties

Your payment history is the single biggest factor in your credit score, making up 35% of it. A late payment of 30 days or more will be reported to credit bureaus and can drop your score significantly, often by 50 to 100 points. The longer the payment is overdue (60 or 90 days), the greater the damage, making it much harder to qualify for loans, mortgages, or even rent a place. Multiple missed payments can lead to collections, charge-offs, or legal action. While catching up before 30 days usually avoids a credit report, you might still be charged a late fee.

How late payments affect your credit report

A late credit card payment can be reported to credit bureaus once it’s 30 days overdue, and the longer it goes unpaid, the more it hurts your credit. If you’re 30 to 59 days late, your credit score could drop significantly, perhaps by 50 to 100 points, depending on your credit history. Being 60 to 89 days late causes even more damage to your score, and you might also face penalty APRs and account restrictions. If you’re 90 days or more late, the account could be sent to collections, severely impacting your credit score and financial reputation. While late payments stay on your credit report for up to seven years, their impact gradually decreases over time, especially if you establish a consistent history of on-time payments.

What to do if you miss the due date

If you miss a payment, act quickly to minimize the damage.

- Pay as soon as possible. If you are only a few days late, you may avoid serious consequences.

- Call your credit card issuer. If it is your first missed payment, many issuers will waive the late fee.

- Set up automatic payments. This ensures you never miss a due date again.

- Check for penalty APR increases. If your interest rate has increased due to missed payments, ask if it can be reduced after six months of on-time payments.

Paying off a credit card in full vs. carrying a balance

There is a common misconception that carrying a balance helps your credit score. In reality, paying in full is the best strategy unless you are in a very specific financial situation.

Pros and cons of paying in full each month

Pros:

- Avoids interest charges: Paying your statement balance in full means you never pay interest.

- Boosts credit score: Lower balances improve your credit utilization ratio.

- Reduces financial stress: Eliminates lingering debt and keeps your budget predictable.

Cons:

- Missed cash flow flexibility: If money is tight, paying the full balance might leave you short on other expenses.

- Missed promotional offers: Some zero-percent APR offers allow you to carry a balance without immediate interest.

When carrying a small balance might be beneficial

In very limited situations, carrying a small balance can have strategic benefits:

- Building credit history: If you are new to credit, making small purchases and paying them off slowly can demonstrate responsible usage.

- Taking advantage of zero-percent APR offers: If you have a promotional zero-percent APR, you can carry a balance without interest during the introductory period.

- Emergency cash flow management: If paying in full would drain your cash reserves, making a partial payment might be a better option to avoid financial strain.

Why credit card companies prefer you to keep a balance

Credit card companies make money when you carry a balance because they charge interest. The longer you don’t pay it off, the more interest they earn. Often, minimum payments are kept small, which means it can take years to pay off what you owe, and that’s good for the credit card company’s bottom line. Many people try to earn cash back or rewards, but they often end up paying much more in interest than they get back in rewards. It’s a common misconception that carrying a balance helps your credit score; in reality, the best way to use a credit card is to use it regularly but pay it off in full each month. This way, you avoid interest charges altogether and keep your credit score healthy.

Can you negotiate a lower payoff amount?

If you’re struggling to pay off your credit card debt, negotiating a lower payoff amount with your issuer might be an option. While not always successful, credit card companies sometimes agree to reduced settlements, particularly if they believe they might otherwise receive nothing. Settlements are more common when an account is significantly past due (typically 90 days or more), has been charged off or sent to collections, or if you can demonstrate a financial hardship that prevents full repayment. These settlements can involve a reduced lump sum payment or a structured payment plan that totals less than the full amount owed.

Settling a debt has potential downsides. It can negatively impact your credit score, as settled accounts are typically marked as “settled for less than full balance.” The forgiven debt might also be considered taxable income by the IRS. Also, having settled debts on your credit report can make it more challenging to secure loans or credit in the future. Before pursuing a settlement, it’s wise to explore alternatives like credit counseling or a debt management plan, which may offer reduced payments without the same negative impact on your credit.

Credit card hardship programs

Many credit card companies have hardship programs for people going through difficult situations like job loss, significant medical expenses, natural disasters or emergencies. These programs, which typically require documented proof of hardship, vary by lender but may include several options. Some lenders offer reduced interest rates or minimum payments to help borrowers manage debt. In rare cases of extreme hardship, a lender might forgive a portion of the debt, particularly if the borrower demonstrates an inability to repay. Because program terms and eligibility requirements differ, it’s important to contact your lender directly to discuss available options.

Strategies for paying off credit cards faster

Paying off credit card debt quickly can save thousands in interest and free up your finances for other priorities. Here are some strategies that can help.

The Snowball and Avalanche Method for faster payoff

Two of the most effective debt repayment strategies are the Snowball Method and the Avalanche Method. The Snowball Method focuses on paying off the smallest balance first while making minimum payments on others. Once the smallest balance is paid off, the freed-up payment amount is applied to the next smallest debt. This builds motivation and momentum. The Avalanche Method focuses on paying off the debt with the highest APR first, minimizing total interest paid. Once the highest-interest debt is eliminated, payments shift to the next highest-interest balance. The Snowball Method works best for psychological motivation, while the Avalanche Method is mathematically the most efficient way to minimize interest costs.

Cutting unnecessary expenses to increase payments

Making larger payments helps you pay off your credit card faster. To increase your payment amount, create a budget to see how much you can allocate to credit card payments. You may need to cut down on unnecessary expenses like subscriptions, eating out, or entertainment. Even a small increase in your monthly payment can significantly reduce your payoff time and interest costs.

Example: a $3,000 balance at 18% APR, paying only the minimum (about $75 per month), will take over 10 years to pay off. Increasing the payment to $150 per month cuts the payoff time to about two years, saving thousands in interest.

Use windfalls (bonuses, tax refunds) to pay down debt

If you get a tax refund, bonus, or have other unexpected cash come your way, use it to help you pay down your debt. Putting these extra funds toward your balance can shave months or even years off your repayment time.

Side hustles and extra income for faster payoff

Earning more money can help you pay off your credit card debt faster. You could try freelancing, gig work or getting a part-time job. Putting all that extra money toward your credit card bill will help you pay it off much quicker and become debt-free sooner.

Balance transfer credit cards as a payoff strategy

A balance transfer credit card can help you pay off debt faster, especially if you can qualify for a 0% introductory APR offer. It lets you move your debt from one or more cards to a new card with a lower interest rate, often 0% for 12 to 21 months. This allows you to pay down your debt with low or no free during the promotional period.

There are some things to watch out for. First, this method requires you to have good credit to qualify for the low or 0% interest rate. Also many cards charge a fee to transfer the balance, which adds to what you owe. If you don’t pay off everything before the introductory period ends, you’ll be charged the card’s regular interest rate, which can be high.

Debt consolidation for faster credit card payoff

Debt consolidation can simplify your financial obligations by combining multiple credit card balances into a single loan with a fixed payment schedule. This approach can help reduce interest rates and make debt repayment more manageable. This method usually also require good credit in order to qualify for a loan with a low interest rate, and there may be upfront fees.

Avoiding the debt trap after paying off a credit card

Paying off a credit card is a significant financial achievement, but staying debt-free requires discipline and smart financial habits. Without a plan, it is easy to slip back into debt.

Moving forward, use your credit cards only for planned purchases and stick to a budget to avoid impulse buys. Make it a priority to pay your balance in full each month to avoid interest charges altogether. Setting up automatic payments can help you avoid missed due dates and potential fees.

Staying debt-free involves more than just paying off one card; it requires a shift in your financial mindset. Building an emergency fund, ideally covering three to six months of living expenses, is essential for handling unexpected costs without relying on credit. Be mindful of lifestyle inflation; just because you have more available credit doesn’t mean you should increase your spending. Prioritize saving and investing by putting money aside before you consider discretionary purchases. Ultimately, a debt-free lifestyle is about making intentional financial decisions that align with your long-term goals, rather than simply satisfying short-term wants.

Tips for building healthy financial habits

The best way to avoid falling back into debt is to adopt habits that promote financial security:

- Track your spending: Use a budgeting app or spreadsheet to monitor expenses.

- Set financial goals: Whether it’s saving for a home, retirement, or travel, having clear goals helps you stay disciplined.

- Limit credit usage: Use credit cards strategically, such as for necessary expenses that you can pay off each month.

- Educate yourself: Continuously learn about personal finance to improve money management skills.

Key takeaways

The key to managing credit cards effectively is understanding how billing cycles, interest, and payments work together. Paying your balance in full each month is the best way to avoid interest and build a good credit score. While minimum payments are an option, they significantly increase the total interest you pay and prolong your debt repayment. Keeping your credit utilization low is essential for a healthy credit score. Strategies like balance transfers and debt consolidation can help you pay off debt faster, but it’s important to be aware of any fees or potential risks. Ultimately, responsible credit card use comes down to smart spending habits, budgeting, and prioritizing saving over borrowing.

Frequently asked questions (FAQs)

The fastest way to pay off a credit card is to:

Make more than the minimum payment each month.

Use the avalanche method to target high-interest balances first.

Apply extra income (such as bonuses, tax refunds, or side hustle earnings) toward your balance.

You can carry a balance indefinitely, but doing so results in continuous interest charges. If you only make minimum payments, it could take years or even decades to pay off your balance.

Yes, paying off a credit card can improve your credit utilization ratio, which is a key factor in your credit score. However, if you close the account, it may slightly lower your score due to reduced available credit.

Paying more than the minimum reduces the principal balance faster, lowering the amount of interest that accrues over time.

Closing a credit card may negatively impact your credit score by reducing your available credit and shortening your credit history. Keeping it open and using it occasionally for small purchases can help maintain your credit score.

The best way to avoid interest is to pay your full statement balance by the due date each month.

Yes, setting up automatic payments can help ensure you never miss a payment and allow you to schedule extra payments to accelerate debt repayment.