Why do you use your credit card? Debt.com asked 1,000 Americans earlier this month. The overwhelming majority answered, “I earn cashback and rewards.” That’s a fair reason. However, further results reveal a bigger problem.

More than one in three Americans need credit cards to make ends meet.

On the same day as our survey, Bankrate released data revealing, “Among credit cardholders carrying a balance month to month, 72 percent are still making an effort to earn credit card rewards.”

“It doesn’t make sense to pay 20, 25 or 30 percent in interest just to earn a few percentage points in cash back or travel rewards,” says Ted Rossman, Bankrate senior industry analyst. “Rewards are great, but only if you’re able to pay in full and avoid interest each month.” Many can’t, at least according to our survey findings. There’s reason to argue that focusing on cashback rewards is a mistake.

Breaking records at break-neck speeds

Credit card balances have ballooned since the worldwide inflation surge began in March 2021. The Federal Reserve releases its Report on Household Debt and Credit every quarter, and credit card balances break new records every three months.

The latest shows “credit card balances increased by $45 billion and reached $1.21 trillion at the end of December 2024.”

According to Debt.com’s survey, rising inflation costs are contributing to the remarkable rise in a short amount of time. Here are the key takeaways from the research:

- 32% of Americans have maxed out their credit cards

- 37% use credit cards regularly just to make ends meet

- 44% say inflation has caused them to carry a larger monthly balance

- Of those maxed out, 80% would rely on credit cards during a financial emergency, and 23% owe more than $20,000 in credit card debt

“Inflation may be easing in headlines, but in households, the impact remains severe,” says Howard Dvorkin, CPA and Chairman of Debt.com. “Our survey shows people are still forced to lean on high-interest credit cards for daily survival – and most haven’t explored solutions to get out.”

What credit card holders should do instead

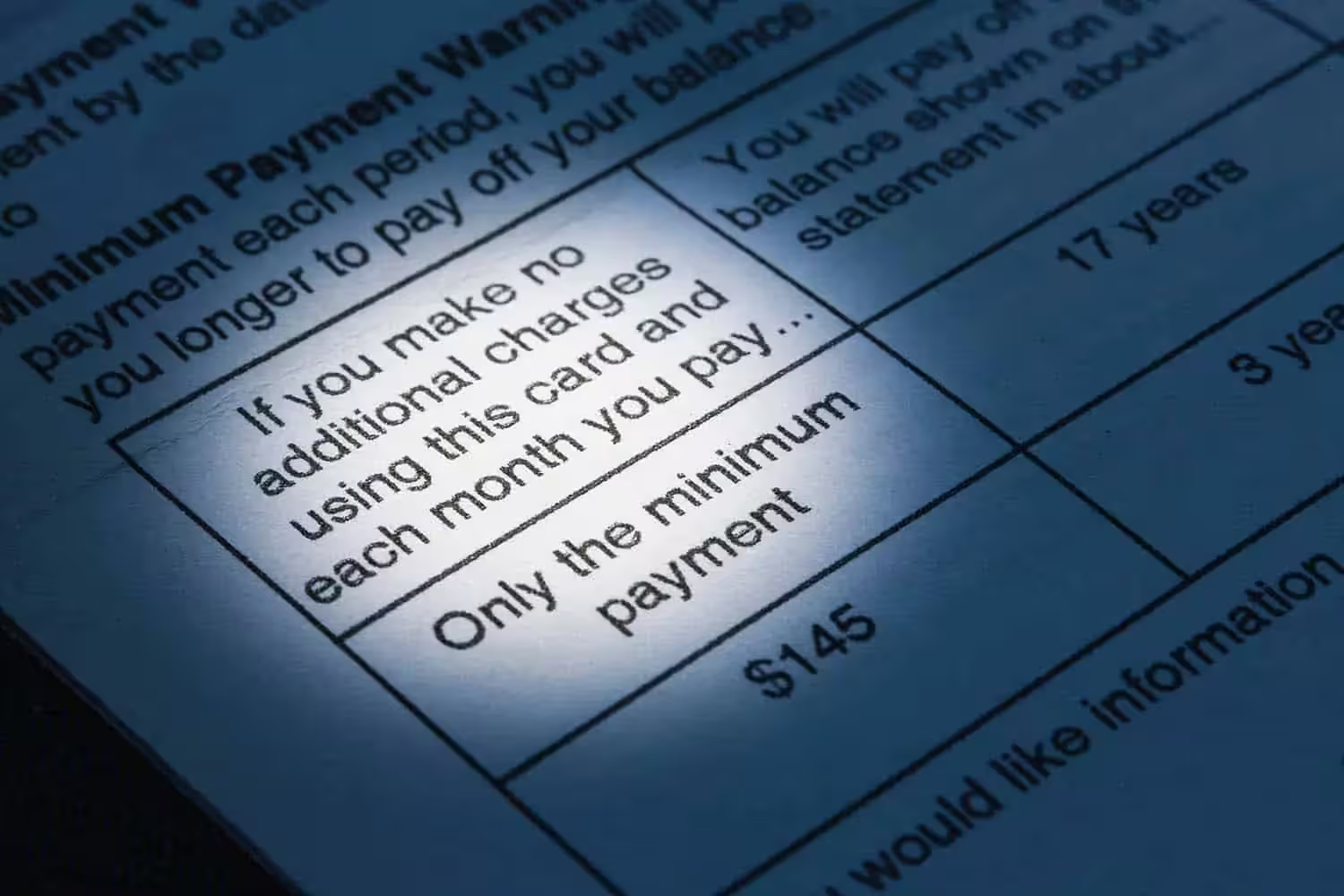

Using credit cards to earn cashback is a useful financial strategy when you pay the balance in full. However, it’s a loss when credit card companies charge interest rates far above the rewards.

A major issue could be how rewards cards are advertised and the consumer’s lack of awareness.

Many people know their cashback rates, but 27 percent of Debt.com’s survey respondents couldn’t tell you their APR.

“We are seeing interest rates above 24%, and 27% of survey respondents don’t even know their APR,” Dvorkin says. “This lack of awareness paired with record-high balances is financially dangerous.”

Despite this huge financial burden, 57% have never considered professional or DIY debt relief options like credit counseling, balance transfers, or debt consolidation. You can save far more money than you’ll ever earn, attempting to build up rewards carrying a credit card balance from every month.

You can start by calling Debt.com at (855) 886-4920. One of our certified debt relief specialists will walk you through a program that can save you time, money, and frustration. It’s free and will have no impact on your credit.