Table of Contents

What is a Credit Bureau?

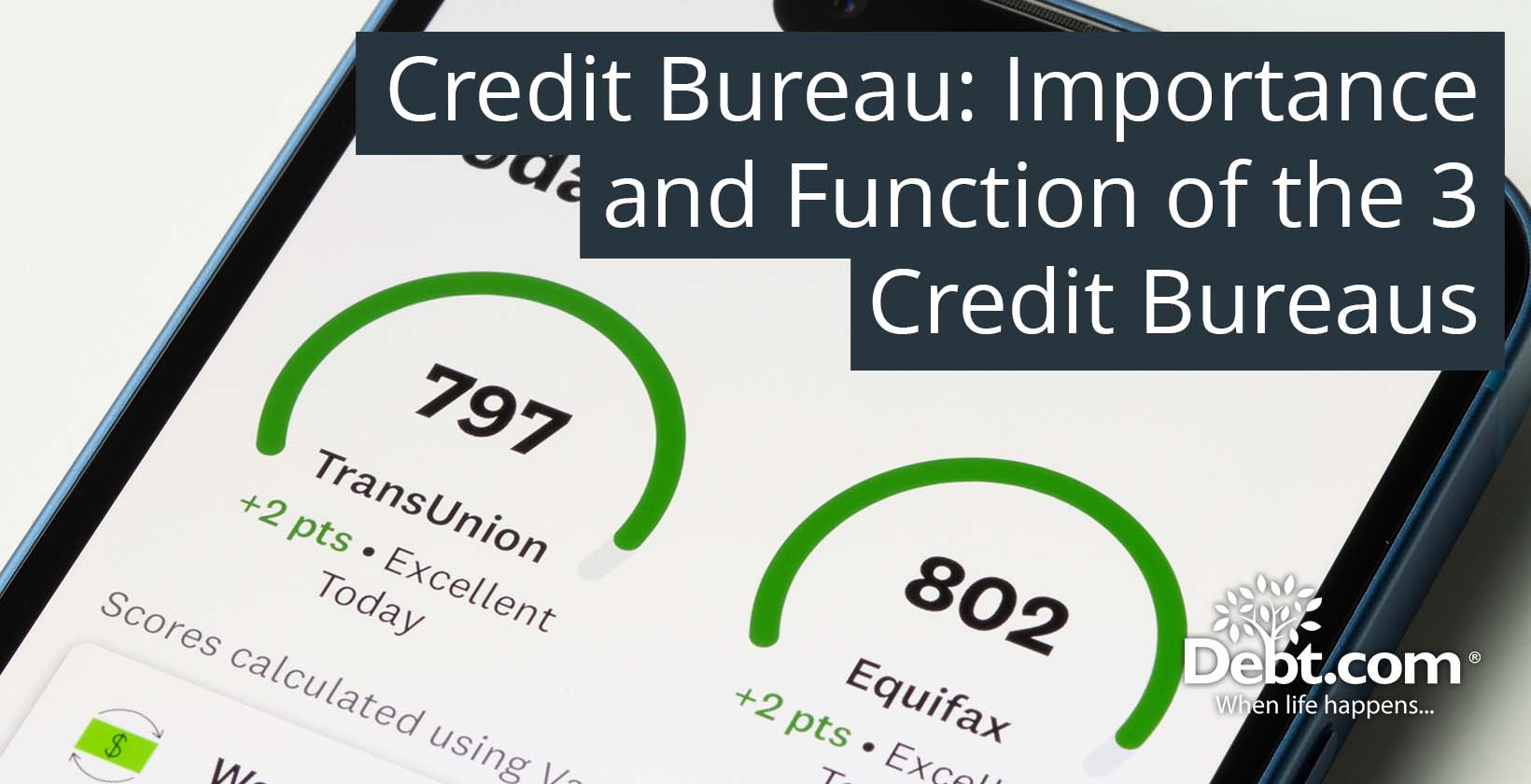

A credit bureau is a vital entity for lenders to assess creditworthiness. These credit reporting agencies are a major contributor to credit scoring and primary source for credit history information. Credit reporting organizations are responsible for collecting credit data which lenders use to determine if a borrower is likely to repay their debts. The question “what are the 3 credit bureaus?” refers to the 3 credit reporting agencies Equifax, Experian, and TransUnion. These 3 major credit bureaus collect information about your credit history and sell it to lenders for managing credit information. The 3 credit bureaus collect lender information in the form of credit data and borrower history that contributes to a potential borrower’s creditworthiness evaluation. These credit reporting organizations are subject to financial regulation.

Credit bureaus provide information creditors and lenders use to help them make important lending decisions. To do this, the 3 credit bureaus keep detailed records called a credit report on most Americans, which is why they are sometimes referred to as “credit report companies” or “credit reporting agencies.” Each credit bureau’s meaning is to perform the same function of collecting and reporting credit data. The credit bureaus are credit companies who track your credit information.

What is the Importance of Credit Bureaus?

The importance of credit bureaus is to maintain an updated list of loan payment histories of debtors’ credit accounts. Credit bureaus provide credit reports to show credit habits of people who can then work on getting better credit scores. Credit tracking and improvement can lead to lower rejection rates on loan requests from lenders. Credit bureaus such as TransUnion, Equifax, and Experian may help in this way with better loan terms, lower interest rates for loan repayment, higher credit limits, and higher approval rate on loan applications.

Positive credit reports result in better loan terms such as favorable repayment period, lower interest rates, and higher credit limits, whereas a poor report leads to loan rejections or less favorable terms with higher fees.

How does a Credit Bureau Influence the Calculation of Credit?

A credit bureau influences the calculation of credit because the credit reports they provide are used to determine credit score. A credit score is calculated based on the information in a credit report. This score is a numerical representation of the creditworthiness of debtors to determine a borrower’s loan risk. Credit bureaus prepare credit reports that are essential for rental applications, employment screenings, and loan rates. This credit information also allows consumers to monitor their financial situation and correct any errors or fraudulent activity.

Credit bureaus impact credit scores according to compiled credit reports from the 3 credit bureaus. The accuracy of a Credit Bureau is determined according to data collected by credit reporting agencies like TransUnion, Equifax, and Experian. The top 3 credit bureaus are generally accurate and consistent with their credit reporting because they compile the same information.

How does the Fair Credit Reporting Act Regulate Credit Bureaus?

The Fair Credit Reporting Act (FCRA) regulates credit bureaus in the United States. FCRA limits credit report information to businesses that make decisions to extend new credit to a consumer. FCRA regulates how credit report information is used to extend new credit to other entities including government agencies and potential employers. FCRA requires the credit reporting companies to offer a specific set of rights to consumers:

- The right to review credit reports

- The right to keep information private

- The right to keep information accurate and repair credit

- The right to request credit scores

- The right to obtain a credit freeze on a credit report

What are the Three Credit Bureaus?

The 3 US credit bureaus are also known as the Big Three credit reporting agencies.

The function of the three main credit bureaus (Equifax, Experian, and Transunion) is to compile and sell credit reports. Experian, Equifax, and TransUnion collect credit account information about consumers’ borrowing and repayment history:

- Original loan amounts

- Credit limit on credit cards

- Current balances on a loan or credit card

- Payment status on those accounts

- Items sent to collections

- Public records of judgments and bankruptcies

It is not possible to say which credit bureau is the most important. The question “what is the most important credit bureau?” is hard to answer because all three credit score agencies in the USA compile the same information and must follow the Fair Credit Reporting Act. The top 3 credit bureaus are:

Equifax

The credit bureau Equifax was founded in 1899. Equifax is the oldest of the credit agencies in the USA. Equifax was founded by Cator and Guy Woolford in Atlanta, Georgia, as Retail Credit Company. By 1920, the company had offices throughout North America. Equifax operates in 24 countries and has nearly$5 billion in annual revenue. Equifax credit reporting agency is traded on the New York Stock Exchange (NYSE) under the symbol EFX.

Experian

The credit bureau Experian formed in 1996 when businesses in the United Kingdom (Credit Data Corporation) and United States (TRW, Inc.) merged. Credit agency Experian is based in Dublin, Ireland. In 2007, it took a controlling interest in Serasa, the world’s fourth largest credit bureau and the biggest in Brazil. Experian is listed on the London Stock Exchange.

TransUnion

The credit bureau TransUnion is a credit reporting agency that was founded in 1968. It operates in 30 countries and is based in Chicago, Illinois. In 2015, TransUnion became a publicly traded company, trading under the symbol TRU. TransUnion is the smallest of all three credit bureaus.

Which Credit Bureau is Most Accurate?

There is no best credit bureau. All the reporting credit agencies offer helpful information and tools for financial decisions. There is no substantial difference between the 3 credit bureaus. Equifax is not necessarily “better” than Transunion. TransUnion is not “better” than Experian. The difference between the bureaus is that not all lenders report to all big 3 credit rating agencies. No law requires creditors to report to every credit reporting company. The question, “Do banks use Transunion or Equifax?” is impossible to answer because each bank in the country can choose among the three major credit bureaus.

What does a Credit Bureau Do?

The meaning of the 3 major credit bureaus is to collect and store financial data about consumers.

- A credit bureau submits financial data to creditors, such as lenders, credit card companies, and other financial companies.

- Equifax, Transunion, Experian are the agencies who tracks all of your credit information.

- There is not much difference between Experian, Equifax, and TransUnion in terms of reporting and data collection.

Lenders contacted the closest credit agency for credit report information before the digital age. TransUnion serviced the Central USA, Experian the West, and Equifax the South and East. The 3 largest credit bureaus are now national corporations.

How do Credit Bureaus Collect Information?

The different credit score companies gather information from your creditors. These creditors include banks, credit card issuers, and auto finance companies. The 3 main credit bureaus also get information from public records like property and court records. Banks, credit unions, retail credit card issuers, auto lenders, mortgage lenders, and debt collectors send detailed information to credit reporting companies:

- When accounts are applied for

- When an account is opened

- Amount loaned or the credit limit

- Account balance

- Status of payments

- If account is in collection

How does a Credit Bureau Create a Credit Report?

A credit service bureau creates a US credit report by compiling and organizing information from sources that relate to an individual’s credit history and financial behavior. What role do the 3 credit agencies play in your credit history and score? The credit report process involves five steps:

- Data collection: The credit check companies gather information from creditors, lenders, and other sources that report financial activities of consumers. These sources include banks, credit card issuers, mortgage lenders, auto loan providers, collection agencies, and public records (such as bankruptcies and court judgments).

- Data compilation: The 3 major credit bureaus compile data into a credit report for each individual. The report includes details such as: personal information (name, address, Social Security number, date of birth, and employment information), credit accounts (type of account such as credit card or mortgage, account balance, credit limit or loan amount, payment history including missed or late payments, and current status of open, closed, in collections), public records (any bankruptcies, foreclosures, tax liens, or judgments), and inquiries (records of who has accessed the individual’s credit report within a certain period, such as creditors or landlords).

- Data verification: The 3 credit agencies verify the accuracy of the information received from creditors and other sources. This involves ensuring that the reported data aligns with what is expected and resolving any discrepancies or errors.

- Credit Report generation: Based on the compiled and verified data, the Credit Report agencies generate a credit report for each consumer. The credit report is a detailed record of the individual’s credit history and financial behavior.

- Distribution: Credit reports are made available to authorized parties, such as lenders, landlords, employers (with consent), and the consumer. Lenders and creditors use these reports to assess the creditworthiness of applicants. Individuals can review their reports to monitor their financial standing.

The three credit bureaus do not make lending decisions or calculate credit scores. The Credit Reporting Agencies provide the information used by lenders. The 3 credit bureau are crucial to helping lenders make decisions.

Are Credit Reports only Made by Credit Bureaus?

Credit reports are not made only by the credit bureau companies of Equifax vs Experian vs TransUnion. Credit reports can be generated by other entities under certain circumstances:

Specialty reporting agencies: Agencies like LexisNexis or CoreLogic may provide reports related to insurance claims history, rental history, or employment background checks. Specialty reporting includes credit-related information.

Tenant screening services: Companies that provide tenant screening services compile reports that include rental payment history for landlords and property managers. Tenant reports include credit-related data alongside other tenant screening criteria.

Check authorization services: Agencies that handle check authorization and verification may maintain databases of individuals’ check writing histories. Check authorization services report bounced checks and unpaid debts.

Background screening companies: Background screening companies include credit-related information as part of comprehensive background checks for employment purposes with the consumer’s consent.

These alternative reporting entities and screening companies are allowed to compile and provide reports that include credit-related information. However, the primary credit reports used by lenders and creditors to assess creditworthiness are obtained from the main credit bureau reporting agencies (Equifax, Transunion, Experion). These reports are governed by regulations such as the Fair Credit Reporting Act (FCRA) and ensure accuracy, fairness, and privacy in the information maintained by credit reference agencies.

Who can Request Access to Credit Reports from Credit Bureaus?

Only companies and individuals who are approved can request access to credit reports. The Fair Credit Reporting Act (FCRA) restricts how all 3 credit bureaus can share data. The credit agencies Experian vs TransUnion vs Equifax provide credit reports to eight categories of institutions and individuals:

- Lenders and creditors: Banks, credit unions, mortgage lenders, credit card issuers, and other financial institutions when individuals apply for credit, such as loans or credit cards. Lenders use these reports to assess the applicant’s creditworthiness and determine lending terms.

- Landlords: Property management companies and landlords request credit reports from prospective tenants as part of the tenant screening process. Credit reports help landlords evaluate the financial responsibility and rental history of applicants.

- Employers: Employers request credit reports as part of the background screening process for job applicants. Employer-requested credit reports are more common for positions that involve financial responsibilities or sensitive information. Employers obtain consent from the applicant before accessing their credit report.

- Insurance companies: Insurance providers can request credit reports when individuals apply for insurance policies, such as auto insurance or homeowner’s insurance. Credit history can be a factor in determining insurance premiums.

- Government agencies: Certain government agencies have permissible purposes to access credit reports for official duties such as determining eligibility for government benefits or conducting investigations.

- Debt collectors and collection agencies: Debt collectors and collection agencies may request access to credit reports to gather information about a debtor’s financial situation. Credit reports can be accessed during debt collection.

- Court orders and legal proceedings: Credit reports are accessed in response to a court order, subpoena, or during legal proceedings where the information is deemed relevant.

- Authorized third parties: Individuals can authorize third party credit counseling agencies or financial advisors to access their credit reports on their behalf.

When are Credit Reports Usually Requested from Credit Bureaus?

Credit reports from the top three credit agencies are requested when an individual’s creditworthiness needs to be assessed. There are common scenarios when credit reports are requested:

- Credit applications: When individuals apply for credit cards, mortgages, auto loans, personal loans, or other types of credit, lenders request credit reports to evaluate the applicant’s creditworthiness. This helps lenders determine whether to approve the application and under what terms (such as interest rates and loan amounts).

- Rental applications: Landlords and property management companies request credit reports as part of the tenant screening process. A credit report provides insight into an applicant’s financial responsibility and ability to pay rent on time.

- Employment background checks: Employers can request credit reports for background screening, especially for jobs with financial duties or access to sensitive information. Employers are required to obtain consent from the applicant before accessing their credit report in many jurisdictions.

- Insurance applications: Insurance companies request credit reports to assess an applicant’s risk profile when applying for auto insurance and homeowner’s insurance. Credit history is also a factor in determining insurance premiums at some companies.

- Credit limit increases: When individuals request an increase in their credit limits on existing credit cards or lines of credit, the card issuer may review their credit report to assess their financial situation and creditworthiness.

- Identity verification: Credit reports are also used for identity verification, especially when individuals need to prove their identity or confirm their address.

- Pre-qualification offers: Lenders request credit reports to make pre-qualification offers to consumers. These offers are not guaranteed approvals but provide individuals with an indication of the types of credit products they qualify for based on their credit profile.

Individuals must give consent before their credit report is accessed for specific purposes.

Is it Legal for a Credit Bureau to Sell Information?

It is legal for the 3 major credit reporting agencies to sell information under certain circumstances. There are certain purposes that justify the sale of credit information by credit reporting agencies:

Permissible purposes: The 3 bureau credit agencies are allowed to sell consumer credit information to entities that have a permissible purpose under the Fair Credit Reporting Act (FCRA). Permissible purposes for the sale of credit data typically include:

- Lenders and creditors who are considering extending credit to consumers.

- Landlords assessing potential tenants.

- Employers conducting background checks with the consumer’s consent.

- Insurance companies evaluating insurance applications.

- Government agencies performing official duties.

- Other entities with a legitimate need for the information as defined by law.

Consumer consent: Consumer consent can be required before credit bureaus (sometimes searched as “credit bureas”) sell certain types of information, especially if it’s not for a permissible purpose defined by FCRA. Consumer consent would typically be needed if the information is not directly related to credit or if it involves sharing information with marketing companies.

Data aggregation and analytics: Credit bureaus aggregate and anonymize data to create market insights or analytics products. Credit data products typically do not contain personally identifiable information and are used for purposes such as trend analysis, risk assessment, and market research.

Compliance with regulations: Every credit bureau (sometimes searched for as “credit barrel”) must comply with regulations and guidelines concerning data privacy, security, and consumer rights. FCRA regulations impose strict requirements on how consumer information can be collected, used, and shared.

Opt-out mechanisms: Consumers have the right to opt out of certain types of information sharing, such as for marketing purposes or certain types of analytics. The three big credit bureaus are required to provide mechanisms for consumers to exercise these rights.

Credit bureaus legally sell consumer credit information under specific circumstances and to entities with permissible purposes, they are subject to stringent regulations to ensure consumer privacy and data protection.

Do Credit Reports from Credit Bureaus have a Huge Impact on Lending Decisions?

Credit reports from the 3 credit reporting agency have a significant impact on lending decisions made by banks, lenders, and other financial institutions. Here’s why credit reports are crucial in the lending process:

Creditworthiness assessment: Lenders use credit reports to assess the creditworthiness of loan applicants. The report provides a comprehensive view of an individual’s credit history, including their payment history, amounts owed, length of credit history, types of credit used, and recent credit inquiries. Creditworthiness information helps lenders evaluate the risk of lending money to a particular individual.

Credit scores: Credit reports include credit scores, which are numerical summaries of an individual’s credit risk based on the information in the report. Credit scores (like FICO scores or VantageScores) provide a standardized way for lenders to quickly assess an applicant’s creditworthiness. Higher credit scores indicate lower risk, while lower scores may suggest higher risk.

Interest rates and terms: Lenders use credit scores and the information in credit reports to determine the interest rates, loan amounts, and terms (such as repayment periods) they are willing to offer borrowers. Individuals with higher credit scores qualify for lower interest rates and better loan terms, saving them money over the life of the loan.

Credit policy adherence: Lenders have specific credit policies and underwriting guidelines that dictate the minimum credit score or credit report criteria a borrower must meet to qualify for a loan. Credit reports help lenders ensure they adhere to these policies and make consistent lending decisions.

Risk management: Lending decisions based on credit reports help lenders manage risks associated with loan defaults and delinquencies. Assessing an applicant’s credit history and creditworthiness can mitigate the risk of extending credit to individuals who do not repay debts or manage credit responsibly.

Credit reports are a critical tool for lenders in assessing the likelihood that borrowers will repay their loans on time and in full. The reports on credit provide a comprehensive snapshot of an individual’s financial behavior and credit management. Credit data influences the terms and conditions under which credit is extended.

How does a Credit Bureau Influence the Calculation of Credit Score?

A national credit bureau influences the calculation of Credit Score by providing the credit reports that a credit score is based on. A credit score is a number that reflects the information in a credit report. The score summarizes an individual’s credit history and helps lenders predict how likely it is they will repay a loan and make payments when they are due.

Lenders use credit scores to decide whether to grant credit, what terms are offered, and the rate that will be paid on a loan. Information used to calculate a credit score can include the number and type of accounts (credit cards, auto loans, mortgages, etc.), if bills are paid on time, how much available credit is being used, whether there are collection actions, the amount of outstanding debt, and the age of credit accounts.

Changes to credit reports cause credit scores to change because credit scores reflect the information in credit reports. Credit score may go down if an individual pays bills late or incurs more debt. Credit score may go up as debt is paid down on an outstanding balance on a credit card or mortgage. Credit score may increase when a credit report error is fixed.

How do Credit Bureaus Help in the Improvement of Credit Scores?

Credit monitoring agencies play a crucial role in the improvement of credit scores by managing and reporting information that directly impacts individuals’ credit profiles. Credit bureaus contribute to credit score improvement in the following ways:

- Accurate reporting: Credit bureaus collect and maintain detailed information about individuals’ credit histories, including credit accounts, payment history, balances owed, and any public records such as bankruptcies or judgments. They ensure that this information is accurately reported on credit reports.

- Credit report access: By providing access to credit reports, credit bureaus empower individuals to review their credit histories. This allows consumers to identify any errors, inaccuracies, or fraudulent activities that could be negatively impacting their credit scores.

- Dispute resolution: Major credit check companies have mechanisms to handle disputes from consumers regarding the accuracy of information on their credit reports. They investigate these disputes and correct any errors found, which can lead to an improvement in credit scores if negative items are removed or corrected.

- Credit score calculation: Credit bureaus do not calculate credit scores, but they provide the data that is used by scoring models (like FICO or VantageScore) to generate credit scores. By accurately reporting positive behaviors such as on-time payments and responsible credit usage, credit bureaus indirectly contribute to higher credit scores.

- Credit education: Some credit bureaus offer educational resources and tools to help consumers understand their credit reports and scores better. This knowledge can empower individuals to make informed financial decisions that positively impact their credit standing over time.

- Monitoring services: The 3 credit bureaus may offer credit monitoring services that alert consumers to changes in their credit reports. This helps individuals detect potential identity theft or unauthorized activities early, preventing negative impacts on their credit scores.

Credit bureaus help in the improvement of credit scores by ensuring the accuracy of credit reporting, providing access to credit information, resolving disputes, and offering resources for credit education. Maintaining good communication with credit bureaus and regularly monitoring credit reports are essential steps towards managing and improving one’s credit profile effectively.

What are the Credit Repair Services related to Credit Bureaus?

Credit repair services related to big credit bureaus typically involve activities aimed at improving a consumer’s credit report and score. These services often target errors, inaccuracies, or negative items on the credit report that may be unfair, inaccurate, or unsubstantiated. There are common activities and services related to credit repair:

- Credit report review: Credit repair services will review credit reports from the major credit bureaus (Equifax, Experian, TransUnion) to identify any inaccuracies or items that could be disputed.

- Dispute process: They assist in disputing inaccurate or outdated information with the credit bureaus. This involves submitting formal disputes, usually in writing, challenging the validity of negative items.

- Negotiation with creditors: Some services negotiate directly with creditors or collection agencies to settle debts or remove negative items from credit reports in exchange for payment or concessions.

- Credit counseling: Providing advice and strategies to improve credit scores, manage debt, and establish better financial habits.

- Credit monitoring: Many services offer ongoing credit monitoring to track changes to credit reports and alert consumers to new issues or improvements.

- Educational resources: Offering resources and guidance on understanding credit reports, credit scores, and how to maintain healthy credit.

Legitimate credit repair services can be helpful in correcting errors and improving credit profiles. Scams also exist in the credit repair industry. Consumers should be cautious of companies that guarantee specific results, charge upfront fees before providing services, or advise illegal tactics like creating a new credit identity.

Why is it Important to Dispute Credit Report Errors to Credit Bureaus?

Individual that find errors in their credit report should dispute the information and request that the information be deleted or corrected. To do so, they contact either the top credit reporting agencies that provided the report or the company or person that provided the incorrect information to the credit bureau. To contact the different credit bureaus, call the toll-free number on a credit report or visit websites for Experian, Equifax, and TransUnion.

Provide information such as name, address, date of birth, and Social Security number for disputing information on credit reports. Identify specific details about the information that is being disputed and explain the basis of the dispute. Have a copy of the credit report that contains the disputed information available. Provide supporting documentation, such as a copy of the relevant portion of the consumer report, a police report, a fraud or identity theft affidavit, or account statements.

It is important to dispute credit report errors with credit bureaus because inaccuracies or errors on a credit report can negatively impact creditworthiness and financial well-being in significant ways:

Impact on credit score: Errors such as incorrect late payments, accounts that do not belong to the consumer, or inaccurate balances can lower credit scores. This can affect the ability to qualify for loans, credit cards, or favorable interest rates in the future.

Creditworthiness assessment: Lenders, landlords, and employers often use credit reports to assess financial responsibility and reliability. Inaccurate information can lead to unfair denials of credit, housing, or job opportunities.

Interest rates and loan terms: Mistakes on credit reports can result in higher interest rates or less favorable loan terms when applying for credit. This costs more money over time in interest payments.

Identity theft and fraud: Incorrect information on credit reports could be a sign of identity theft or fraud. Disputing errors promptly helps identify and address unauthorized activity on accounts before it causes further damage.

Personal finance management: Ensuring the accuracy of credit reports is essential for managing personal finances effectively. Accurate information helps make informed decisions about borrowing, saving, and budgeting.

Disputing credit report errors with a credit bureau USA involves particular steps that include:

- Submitting a dispute: Submit a dispute directly to the credit bureau(s) that issued the inaccurate report. This can usually be done online, by phone, or by mail.

- Investigation process: Upon receiving a dispute, the credit bureau will investigate the disputed items. They will typically contact the creditor or entity that provided the information and ask them to verify the accuracy of the data.

- Resolution of dispute: The credit reference agency must investigate disputes within a certain timeframe (often 30 days) and provide consumers with the results of their investigation. If the disputed information is found to be inaccurate or unverifiable, the credit bureau must correct or delete the information from the credit report.

- Updating Credit Reports: If the disputed information is corrected, the top credit reporting companies will update the credit report and send the consumer a revised copy. They will also notify any other US credit bureau that received the incorrect information.

Disputing credit report errors promptly and following up to ensure corrections are made protects credit standing. This is crucial for maintaining good credit and accessing financial opportunities on fair terms.

How to contact credit bureaus

Contact Equifax

P.O. Box 740241

Atlanta, GA 30374-0241

(800) 378 4329

www.equifax.com

Get a free credit report or dispute information.

*You can also get your free credit report from annualcreditreport.com.

Contact Experian

P.O. Box 4500

Allen, TX 75013

888-397-3742

www.experian.com

Get a free credit report or dispute information.

*You can also get your free credit report from annualcreditreport.com.

Contact TransUnion

4530 Conference Way S

Boca Raton, FL 33431

(800) 916-8800

www.transunion.com

Get a free credit report or dispute information.

*You can also get your free credit report from annualcreditreport.com.

Contact Innovis

P.O. Box 1358

Columbus, Ohio 43216-1358

1-800-540-2505

www.innovis.com

Get a free credit report or dispute information.

*A free credit report is not available through annualcreditreport.com. You must contact the company directly.

Credit Bureaus FAQ

There are three major credit bureaus, Experian, Equifax, and TransUnion. Additionally, there are numerous smaller credit reporting agencies with limited scopes of activity.

The Fair Credit Reporting Act requires credit bureaus to be accurate and timely, but it does not give specific update times. Credit bureaus are dependent upon the information provided to them by creditors. After they receive updates, the CRAs adjust credit files. It can take as much as a month for changes by creditors to be noted on a consumer credit report. The credit reporting agencies must go through a process to make sure the information is valid. Any errors or questions can delay the reporting procedure.

Bankruptcy courts do not report information to credit reporting agencies. However, credit bureaus will collect information about bankruptcy because they have access to public records. They have automated this process and use sophisticated services to gather that information.

Yes, and no. You can’t contact credit bureaus directly and tell them about payments you regularly make. However, you can allow credit bureaus to know about your payments to utility companies and report your rent. Programs such as Experian Boost will let you report utility and other regularly reoccurring bills. This action is a form of “self-reporting” because using this type of service will include new information in your credit profile that wouldn’t be included otherwise.

Collection agencies can report an account to the credit bureau as soon as they purchase the debt. However, if you dispute the debt during the debt validation process and can prove that the collector does not have all information necessary to verify the debt, then you can ask the credit bureaus to remove the account. Otherwise, it will remain for seven years from the date the account first became delinquent. For medical collection accounts, there are special rules. The collection agency must give you 180 days to settle the account or work with your insurance company to make sure it is paid. After 180 days, they may report the account.

Generally, credit card companies will report to the credit bureaus only if you are more than 30 days late, but some do not report missed payments until 60 days after the due date.

The credit bureau’s data is used to create your credit report, and your credit score is built upon the information in your credit report. The most common scoring systems are FICO and VantageScore. VantageScore is a credit scoring model developed by the three credit bureaus in an effort to compete with FICO, which is used in 90% of lending decisions. However, VantageScore is a separate company and not part of the three major credit reporting agencies. VantageScore is the scoring model used by many popular credit monitoring apps, including Credit Karma.

Do all credit bureaus work the same way?Mostly, but not exactly. Credit bureaus have the same general methods of operation. They receive data about your credit behavior from your creditors and record them for your credit file. Each bureau operates slightly differently and highlights different aspects of your financial history in your credit report. Equifax summarizes “open” and “closed” accounts. This makes it easier to dispute. They also show an 81-month history. Experian will show you when closed accounts are going to drop off from your credit report. TransUnion has the most complete employment section.Do all credit bureaus work the same way?

Yes. In fact, over one-third of credit reports have errors, according to a consumer reports study published in 2021.

Federal law (FCRA) requires that the credit bureaus give you a free report once every twelve months. They are also required to provide a free report to verify that a disputed item has successfully been removed from your credit report. Some states require the credit bureaus to provide additional free reports each year. Currently, the credit bureaus have agreed to provide free reports each week during the pandemic until April 2022. However, this is not required by law.

Yes, because they are separate companies, they do not share information about credit disputes. If an error appears on all three of your reports, you will need to make three disputes. Alternatively, you can make the dispute once with the data furnisher, and if you are successful in that dispute, they must correct the information with all three bureaus.

The credit bureaus are required by law to respond to your dispute request and contact the original creditor to verify the disputed information. They will use any information or documentation you provide. Then they ask the creditor to investigate and verify the information. Any information that cannot be verified must be removed. The bureau will then notify you of the results. The results must be provided within 30 days unless the credit bureau requested more information from you; in that case, they have 45 days.

Yes, but you’ll need to have a solid case. The Fair Credit Reporting Act (FCRA) does allow a consumer to sue a credit bureau in Federal court for a failure to correct errors in your report.

Credit bureaus can and do sell information about your creditworthiness to companies so those companies can market to you. When you receive “prescreened” offers for loans and credit cards, you should know that happens because your data was sold to them. You can opt-out of those mailing lists by visiting OptOutPrescreen.com or by calling 888-567-8688.

The regulations contained in The Fair Credit Reporting Act (FCRA) governs what credit reporting companies can and cannot do. Individual states may also have additional credit protection laws for consumers. You can contact your state Attorney General’s office for more information.

Because credit bureaus are private companies and competitors, they do not share most information. While this is beneficial to your privacy, this can also cause some confusion. Not every company shares credit information with the major bureaus, so your good credit habits may not be recorded with all three CRAs. Additionally, credit report disputes and credit freezes are not shared between the bureaus. Only fraud alert information is shared between them.