The Consumer Financial Protection Bureau just announced it “finalized a rule to remove medical bills from credit reports.”

It’s a move that will impact 15 million Americans collectively on the hook for $49 billion in medical bills. The CFPB says it will “end coercive debt collection practices that weaponize the credit reporting system.”

“People who get sick shouldn’t have their financial future upended,” CFPB Director Rohit Chopra said in a press release. “The CFPB’s final rule will close a special carveout that has allowed debt collectors to abuse the credit reporting system to coerce people into paying medical bills they may not even owe.”

The CFPB press release states the rule will go into effect 60 days from January 7.

If you currently have an unpaid medical bill and are concerned, keep reading to learn how (and how long) it will take to end up on your credit report and what you can do to prevent negative remarks from happening.

Table of Contents

Can medical bills affect your credit?

Technically, no, medical bills do not affect your credit. Even if you rack up a hospital bill that’s thousands of dollars, that charge should not appear on your credit history – not until that bill has gone unpaid by its marked due date (every medical bill must have one) and is delinquent enough to be sent to collections.

It’s not until a medical bill turns into medical debt that your failure to pay will make its way to credit bureaus, an important technicality to keep in mind. According to the CFPB’s latest ruling, medical bills won’t impact your credit report moving forward.

Previously, medical debt could drastically affect your credit score if it made its way onto your credit report. It’s been an unpleasant reality for many Americans with medical debt. However, the CFPB conducted its own research, concluding medical bills don’t help predict whether a consumer will repay a loan.

The organization goes as far to say it expects the new rule will “lead to the approval of approximately 22,000 additional, affordable mortgages every year and that Americans with medical debt on their credit reports could see their credit scores rise by an average of 20 points.”

This could provide a sigh of relief for many. Outstanding medical bills are still one of the biggest financial burdens on Americans. Estimates show it affects nearly 1 in 5 American adults or approximately 23 million.

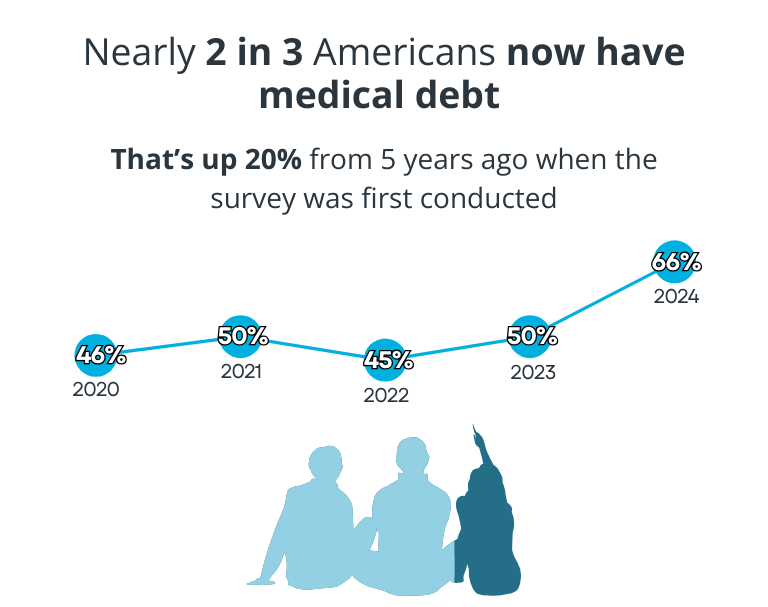

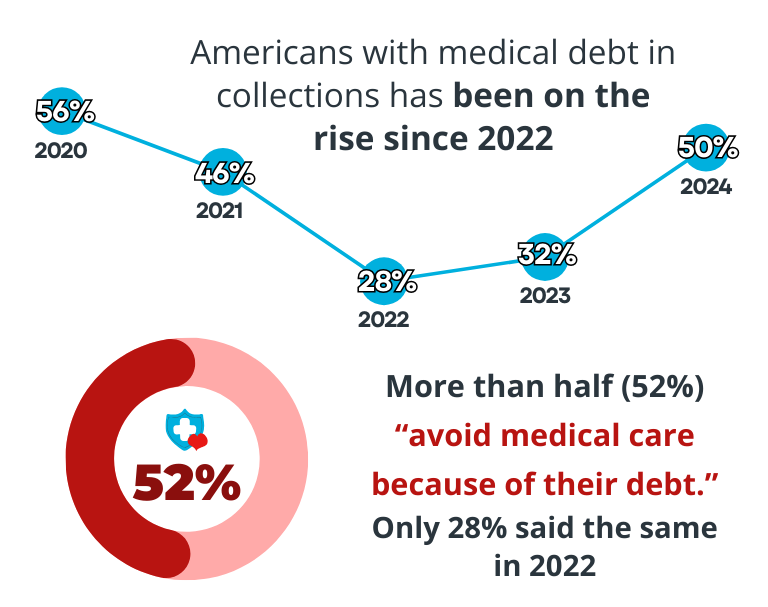

Debt.com’s in-house research shows the percentage of Americans with medical debt has steadily increased by 20% over the past five years.

Most medical debt arises from what’s known as ‘surprise bills.’ These are the unexpected procedures or other charges that can occur when seeing a healthcare provider.

Medical bill vs. medical debt

The only difference between a medical bill and medical debt is timing.

A medical bill is simply an owed payment between you and a service provider, like getting a check at the end of a meal or an invoice from a mechanic. Unlike those tabs, medical bills typically have a 30-day repayment period (the exact timeframe can vary by provider).

The hospital or doctor’s office does not report this payment to a credit bureau during this time. And why would they? There’s no reason to assume that you, the patient, would not pay your hospital bill just because you haven’t paid before the deadline.

A medical bill becomes medical debt when that bill is outstanding and goes unpaid by the due date. At this point, late payment may be noted or the charge might end up going to collection.

What happens if you don’t pay medical bills?

If you have unpaid medical bills, you don’t have to worry about that debt immediately being sent to collections or credit bureaus once it’s overdue. Shady practices in the medical billing and debt industry led to the creation of the National Consumer Assistance Plan, which gives consumers six months before any medical debt is noted on their credit report. The three major credit bureaus (Experian, Equifax, and TransUnion) created the plan to make credit reports more accurate and protect consumers. Here’s the timeframe of how your medical debt is reported and handled by credit bureaus. Keep in mind the information below outlines the process before the CFPB’s 2025 rule:

1. Sent to collections

Your healthcare provider will send an unpaid balance to a debt collection agency within 90 to 180 days. However, it’s possible to delay this process. One option is to ask them to set up a payment plan, which indicates that you’re willing to pay something. The other option is to be in contact simply to let them know that you know the medical bill even if you can’t afford to pay it. The key is communicating with your healthcare provider and letting them know you aren’t skipping out on your bill. While this may not prevent negative remarks on your credit score or stop the collections process, it can go a long way to delaying it.

2. Grace period

Once your medical bill has been handed over to a debt collection agency, there’s a six-month grace period before the unpaid medical collection debt appears on your credit report. This is intended to give insurance payments enough time to be disbursed or any bill disputes to be settled; medical bills are often moved to collections very quickly without the knowledge of the patient.

3. The collection appears on your credit report

After the grace period ends, the collection agency can submit your unpaid debt to credit bureaus, but only if they have communicated with you to inform you of your outstanding debt. Once they have done so, either by speaking on the phone, in person, or in writing, the debt will likely appear on your credit report within 30 days, along with the close of the business cycle.

Once the collection has been reported to your credit report, it’s usually there for good until the negative item expires after seven years. Paying off the debt doesn’t remove the negative remark. There are a few exceptions, however. If the collection item is inaccurate or the collection agency can’t prove the debt is yours and/or legitimate.

Even if you end up with medical debt in collections, there may still be a chance to salvage your credit if you pay it off as soon as possible. If you can’t pay it all off immediately, consider a number of medical debt relief methods, such as consolidation, settlement, or, in drastic cases, bankruptcy.

Take care of your medical debt before your credit score gets majorly hurt. Contact us today.

How do medical bills affect your credit score?

In March of 2022, the three major consumer credit bureaus, Experian, Equifax, and Transunion, changed how and when medical debt in collection is reported. The updated medical collection debt reporting gives consumers much better protection against this common source of debt. However, the 2025 CFPB rule takes it a step further with amendments to Regulation V, a federal regulation that implements the Fair Credit Reporting Act.

FICO 8

This is the most commonly used score among creditors and lenders to determine your creditworthiness. In this scoring model, medical collections accounts are treated the same. As of the 2022 updates, medical collection debt of $500 or less will not be included. This will keep two-thirds of medical collections off of Americans’ credit reports!

FICO 9

This scoring model weighs medical debt differently from FICO 8. Paid collections accounts are ignored, and medical collections accounts don’t affect the score as much as other collection account types.

VantageScore 3.0

This score is commonly used for credit monitoring apps like Credit Karma. VantageScore 3.0 ignores collection accounts altogether. This sounds great, but be wary – if you only monitor your credit score through these apps, they can give you an unrealistic picture of the state of your credit health, and your FICO 8 score could be vastly different.

VantageScore 4.0

This version of VantageScore only counts medical collections accounts that are six months or older. Like FICO 9, medical collections accounts don’t affect VantageScore 4.0 as much as other collection accounts.

How long do medical bills stay on your credit report?

I received a notice about a medical bill that got sent to a debt collector, even though I swore my insurance had paid it. When I looked into it I found out that the claim was denied. I’m appealing, but how does it affect my credit since it’s already been sent to a collection agency?

—Agnes in Denver, CO

Credit expert Gerri Detweiler responds…

Agnes wrote to Debt.com before the 2025 CFPB rule that amended Regulation V and implemented the FCRA. A CFPB press release of the rule states it bans credit reporting agencies from including medical debt on credit reports and credit scores. The press release also states the rule goes into effect “60 days after publication.”

It’s still worth understanding how medical bills have impacted credit reports historically.

You’re right to be concerned about how this medical debt may affect your credit reports. According to the CFPB, over half of all credit report collection accounts are due to medical bills. Collection accounts can lower your credit scores significantly (30-70 points or more) and remain on credit reports for 7 1/2 years from the date the bill was missed with the original creditor.

How medical collections affects your credit report

Depending on how old this bill is, the collection account may not yet appear on your credit reports. The major credit reporting agencies won’t include medical debts that are less than 180 days past due (from the date of service). For the most part, that period gives consumers time to resolve medical billing issues or work out payment arrangements with providers.

The only way to know is to check your credit reports with all three major credit reporting agencies, Equifax, Experian, and TransUnion, which you can do for free at Annualcreditreport.com. It’s a good idea to order a copy of your report with each major credit bureau since some collection agencies don’t report to all three. In addition, it would be a good idea to monitor your credit scores with all three credit bureaus so you’ll be alerted to any changes.

How long can medical collections stay on my credit report?

An unpaid collections account can stay on your credit report for seven years. However, if your insurance company pays a medical collections account, it is removed from your credit report immediately.

How to deal with the medical collection agency

If this debt does not yet appear on your credit reports, ask the collection agency what needs to happen to keep it from being reported. It may be willing to agree not to report it if you pay the full amount right away. (If the collector does agree to this, make sure you get it in writing.) You could then pay it, assuming you can afford to do so, appeal the insurance decision, and ask your insurance company to reimburse you rather than the provider if it decides to pay some or all of the bill.

Tip: If you have employer-based health insurance, ask your employer to put you in touch with an insurance representative who may be able to assist you with the appeal.

If it has been more than six months since you received the medical services, you may find a collection account on your credit reports. If that’s the case, you can still try to work with the collection agency. Let the collector know you are appealing the insurance decision and ask what your options are to get this account off your credit reports while you wait for the insurance company to process the appeal. It may be willing to suspend reporting during this time. (It’s a good idea to follow up any conversations in writing, describing what was agreed. Send correspondence with tracking and keep a copy for your records.)

You can still dispute the item on your credit reports if it is unwilling to do this. Under the Fair Credit Reporting Act, you have the right to dispute information on your credit reports directly with each credit reporting agency that is reporting it. (It’s a good idea to file your dispute in writing, as mentioned before.)

That should buy you some time while you appeal it. If the insurance company agrees later to pay it, you should then be able to permanently remove it from your credit reports. If your insurance company refuses to change its decision, it’s possible the account will continue to be reported as a collection account after the dispute has been investigated.

Finally, you may want to check with your state insurance commission to find out if there are state laws that provide further protection. States such as Nevada and Maryland have recently passed consumer-friendly legislation that provides additional protections for residents dealing with medical bills. It’s worth checking whether your state has laws that may help you resolve this debt.

Keeping medical bills off your credit report

The key to preventing a medical bill from being a blemish on your credit score is to catch it before it becomes debt. Here are a few ways to keep it from getting that far:

Review your bill

This seems like a no-brainer, but did you know that up to 80% of medical bills have a mistake? Don’t be afraid to ask questions about the procedures you’ve been charged for, and ensure every line item is correct. One way to check for billing errors that’s also an effective way to lower your medical bills possibly is to ask for an itemized bill.

Dispute errors

If you find an error on a bill, don’t keep it to yourself. Call your provider’s office and alert them to the incorrect items. They will either explain why it’s correct or be able to fix it for you.

Talk to the bill issuer to work out a plan

Your doctor or hospital may be able to set up a payment plan that allows you to make small payments each month instead of paying everything at once. If you think this would be feasible for your budget, ask about working out a plan.

Negotiate

Your medical bills aren’t necessarily set in stone. Some offices are willing to negotiate the price as long as they get paid.

“Negotiating medical bills is like negotiating any other debt,” says Gerri Detweiler, a credit expert and contributor on Debt.com. “You might even consider negotiating before it goes to collections if you can come up with a lump sum to pay it off.”

Hire an advocate

Skip all the headaches by hiring a medical bill advocate. These are professionals who are experienced in all the above techniques. They will do their best to ensure that all charges are accurate and to attempt to reduce your bill as much as possible. Most of them charge a percentage of how much they saved you—so it’s very much in their best interest to earn you the most savings possible,

How to remove medical debt collections from credit reports

Ask for proof

When a debt collector contacts you about an outstanding debt, you can ask them for proof. Don’t blindly trust them when they tell you that you have medical debt. By law, they must verify the debt. They have to send you the debt amount, the creditor’s name, and the applicable terms and conditions.

File a dispute if it’s inaccurate

If you ask for verification and the collector has incorrect or incomplete information, you can dispute it with the credit bureaus to get it off your credit report.

Find out how old the debt is

You may not have too long until your seven years are up, and the medical debt gets removed from your credit file. Checking the age of your debt also tells you whether you are within the statute of limitations and can still be sued.

Note on pay-for-delete

Some consumers who pursue medical debt relief through debt settlement may want to try the “pay for delete” method to remove it from their credit reports. This could be unnecessary because the National Consumer Assistance Plan states that medical collection accounts paid by an insurer will be immediately removed from credit reports.

A medical bill question for one of our financial experts…

Question: I was recently informed by a debt collection agency that my bill from a clinic was forwarded on to them by the clinic. It is for $4,300, which I can’t afford to pay right now. Will my credit standing suffer if I set up a payment plan with the debt collector? Is it better to put it on a credit card? I have been thinking of consolidating all of my credit card debt and medical debt too if possible – who is reputable? Thanks for your help. – Steph L.

Gerri Detweiler, Credit Expert, responds…

Hi Steph,

It sounds like there are several issues you are grappling with:

- You have found out a medical bill you owe has gone to collections, and you can’t afford to pay it

- You are concerned about maintaining your credit rating

- You have additional debt you are struggling to repay

Let’s look at each of these issues so you can make an informed decision about your next steps.

Medical debt in collections

Medical debts in collections are responsible for over half of all collection accounts on credit reports, so you’re certainly not alone in your concerns about paying this debt. Before your medical bill being turned over to collections, did you make any attempts to work something out with the clinic, such as requesting a reduction in the balance and/or a payment plan? If not, you may want to at least attempt to do that first.

Contact the original provider and ask if they can pull it back from collections so you can resolve the bill with them directly. This approach eliminates the risk that the debt will be listed on your credit reports as a collection account. You may also be able to work out an interest-free payment plan directly with the provider.

Using a credit card for medical bills

If you can’t work out a payment plan with the original service provider, you may want to charge the full amount to a credit card. This would help you avoid potentially damaging your credit with the collection account.

New rules in credit reporting give you more time to deal with medical debt, so it doesn’t negatively affect your score. But credit damage is still possible. If you don’t take care of the collection account within 180 days, the collection agency may report it to the credit bureaus. Then, it could negatively affect your score.

If you decide to go this route, work directly with the original service provider. However, only consider using a credit card to pay the bill if you are confident you can pay back the credit card debt in a reasonable period of time. Otherwise, you’ll take an already unaffordable debt and make it more expensive through additional interest charges.

This strategy is a bit of a long shot since the debt has already been turned over to a collection agency, but it’s worth a try.

Free help to evaluate your options is available here. Find the best way to get out of debt for your needs, budget, and goals.

Options for relief if you have to go through the collection agency

If that doesn’t work, you’ll have to communicate directly with the collection agency. You will have several options at that point:

Option No. 1: Pay off the collection account immediately

Offer to pay off the debt in full if the collection agency confirms it won’t report to credit bureaus. Get written assurance from the collection agency that it has not reported the debt and will not report it to the credit reporting agencies. The fastest way to do this is to use a credit card. However, consider the additional cost of interest you might have to pay interest.

Option No. 2: Set up a payment arrangement with the collection agency

Setting up a payment plan won’t necessarily prevent the collection account from appearing on your credit reports, but it might. A few major collection agencies will not report collection accounts if the borrower enters into a repayment plan soon after being contacted about the debt and pays on time.

If you attempt to go this route, ensure the collector clearly states its credit reporting policy in writing. It should provide a written description of any fees or interest that will be added to the debt. Compare what they will charge to the cost of paying with a credit card.

Option No. 3: Settle the debt with the collection agency.

You may be able to negotiate a reduced payoff amount for the debt. There’s a good chance the collection agency has either purchased the debt for less than the full amount or is collecting on behalf of the medical provider. Either case would give them some flexibility to accept a lesser amount. This will likely result in a collection account on your credit. The balance should be updated to show it’s been paid.

If you’re thinking of consolidating, start with a phone call…

You indicated that you are considering debt consolidation because you have other debts. If that’s the case, your first call should be to a reputable credit counseling agency even before you contact the medical provider or collection agency. The counselor can help you review your debts and budget so you can evaluate how this debt fits into your overall financial situation.

If you discover, for example, that you can’t pay back your debt with the help of a counseling agency in five years or less, you may need to consider debt settlement or even bankruptcy. While those options may hurt your credit in the short term, they could allow you to put your debts behind you. You can then start rebuilding your credit and reaching your financial goals. If you’re still not sure which option is right for you, call , and Debt.com will match you with the right solution based on your needs, credit, and budget.

Other questions about unpaid medical bills

Your wages can be garnished because of medical bills only if the collector sues, receives a judgment, then gets a court order. Many collectors don’t think this is worth the trouble, given that filing a civil suit will cost them money. However, it depends on the collector. Some other collectors file suits in the hopes you will ignore the court summons, which allows them to get a deficiency judgment against you.

If you accrue medical debt while on a visitor visa, your sponsor could be held liable for what you owe.

In some cases, medical debt can result in a property lien. Ignoring the debt can lead to you being sued, which can lead to a lien being placed on your property for the amount you owe.

No, only paid medical expenses can be claimed on taxes. Outstanding bills don’t count.

This depends on a few different factors. First, was the deceased covered by Medicaid?

If they were, the state can recover the payments they made from when the deceased was 55 years old until the time of their death. If they didn’t have Medicaid, the estate is responsible for paying any outstanding medical bills. Certain states require adult children to cover what the estate can’t. The bottom line with this question is you must check your state laws to be sure.

Debt collectors can sue for unpaid medical bills. Although it isn’t very common, it’s still best to pay off medical debt as soon as you can to prevent this from happening.

Unless your medical office chooses to deal with your unpaid bills themselves. The bill will likely go to collections within 90 to 180 days after your missed payment.