Debt Awareness Week Daily To-Do List

Know What You Owe

Debt awareness starts with knowing where you stand.

Today’s challenge:

List all your debts and their balances. The first step to tackling debt is understanding what you owe!

Task: Write down all your current debts—credit cards, student loans, auto loans, personal loans, and mortgages. Include the outstanding balance and minimum monthly payments for each. Click here to download the Budgeting Worksheet.

Spot the Interest

High interest can make paying off debt feel like an uphill battle.

Today’s challenge:

Record the interest rates for each of your loans and credit cards. Knowing which debts to target first can help you save in the long run!

Task: Identify the interest rates for each of your debts. Highlight which debts have the highest rates and which ones may be costing you more than you realize. Click here to download the Interest Rate Worksheet.

Track Your Spending

Small purchases add up quickly!

Today’s challenge:

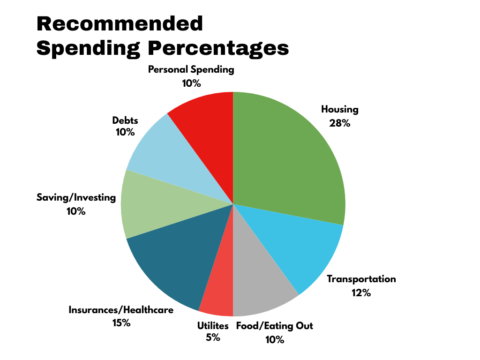

Review your spending over the past 4 weeks and tally your totals for categories like groceries, dining out, and subscriptions. Where can you cut back?

Task: Tally up the last two weeks of spending in categories like gas, dining out, groceries, subscriptions, and pet supplies. Highlight any areas where you might be overspending.

Click here to download the Spending Worksheet. Use this worksheet to compare your spending to the recommended amount.

Find Your Financial Triggers

We all have financial triggers that lead to extra spending. Is it sales, stress, or social events?

Today’s challenge:

Identify your spending triggers and write them down so you can stay ahead of impulsive purchases.

Task: Reflect on your spending habits and identify your “debt triggers”—situations where you’re more likely to spend impulsively or rely on credit (e.g., online sales, emotional spending, or emergencies). Click here to download the Debt Triggers Worksheet to journal how to avoid them.

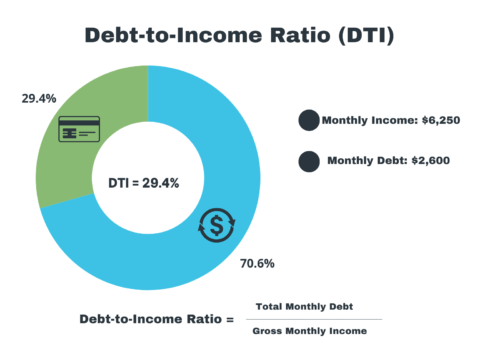

Calculate Your Debt-to-Income (DTI) Ratio

How much of your income goes toward debt?

Today’s challenge:

Calculate your debt-to-income ratio (DTI) by dividing your monthly debt payments by your monthly income. A lower DTI means more financial flexibility!

Task: Add up your total monthly debt payments and divide that number by your monthly income to calculate your debt-to-income ratio. Understanding your DTI helps you see how much of your income goes toward debt. Click here to download the Debt-to-Income Ratio worksheet to track your current DTI.

Review Your Credit Report

Your credit report tells your financial story.

Today’s challenge:

Download your free credit report and review it for accuracy. Knowing what’s on your report is key to improving your financial health!

Task: Check your free credit report at AnnualCreditReport.com and review it for any errors or unfamiliar accounts. Take note of your total credit usage and any past-due accounts. Click here to download the Credit Report Review Worksheet to track your current credit score, credit usage, and errors to report to the three major bureaus.

Set Your Debt Goals

Now that you’ve learned more about your debt, it’s time to make a plan!

Today’s challenge:

Set one short-term and one long-term debt goal. Whether it’s paying down a credit card or saving for emergencies, every small step counts!

Task: Write down at least one short-term and one long-term debt-related goal (e.g., paying off a credit card, building an emergency fund, or refinancing a loan). Outline a small action you can take to get closer to each goal. Click here to download the Debt Goal Worksheet to journal your short-term and long-term, debt-related goals and action items to meet them.